This week, Vodafone New Zealand launched a contact centre solution known as Vodafone Connect that runs on AWS cloud infrastructure. The solution is designed for contact centres and customer service providers to reduce their operating cost and deliver an improved customer experience (CX).

The move comes as many businesses and governments are witnessing a spike in inbound contact centre volumes since the outbreak of the pandemic. The telecom company aims to help the contact centre industry through its on-demand contact centre suite of solutions that can be scaled up or down according to the organisations’ requirements. It can be combined with existing CRM platforms in a single dashboard for better access to data and resolution support.

Vodafone Connect is built on the AWS Connect cloud contact centre solution and uses data analytics and machine learning tools to automate customer interactions across multiple channels – email, messaging and social media – to support the contact centre agents with real-time information.

COVID-19 has accelerated the move to the cloud

The recent pandemic has seen many organisations make a leap almost overnight to cloud contact centre technologies. Many organisations that previously had concerns around data privacy, and securing customer data – and were thus hesitant about deploying cloud contact centre solutions – have moved to the cloud model. The cloud model helped get agents that were forced to work from home up and running in a short duration. The immediate urgency was primarily due to a massive spike in voice calls and non-voice activity such as emails. During the COVID-19 crisis, many organisations used Virtual Private Network (VPN) connections to their legacy on-premises phone system to enable the remote agents. However, there have been challenges reported by many organisations with that approach such as increases to IT budget, difficulty in scaling easily, and the requirement for more IT support that could have been avoided.

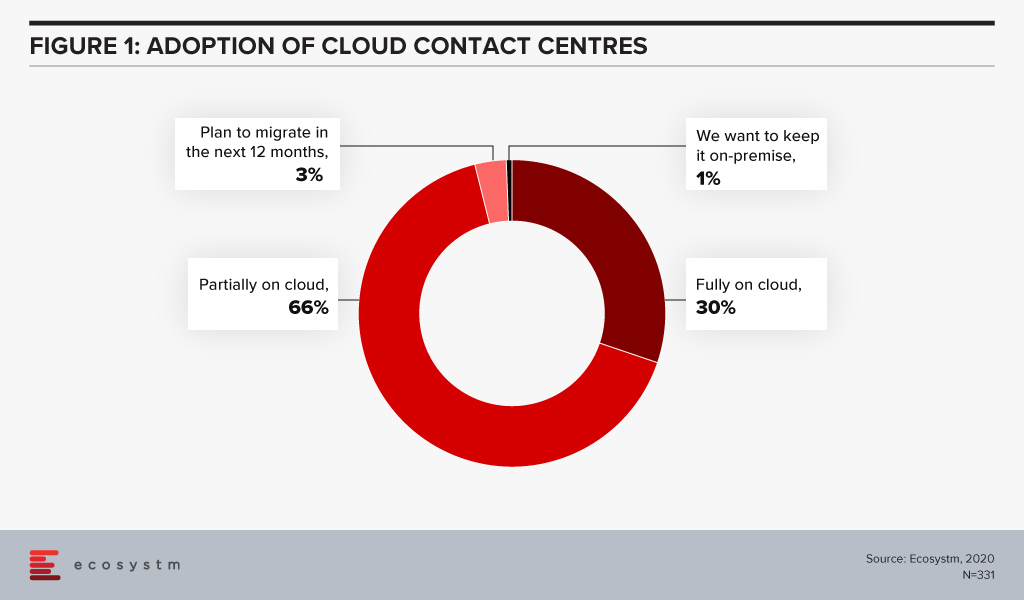

Ecosystm research finds that only 30% of organisations have fully migrated their cloud contact centre solutions on the cloud.

This indicates a market opportunity for vendors in the cloud contact centre space. The COVID-19 pandemic has definitely triggered a strong move towards the cloud model. It has become imperative for vendors and solutions providers to strengthen their cloud capabilities.

Driving an Omni-Channel Experience has become increasingly difficult

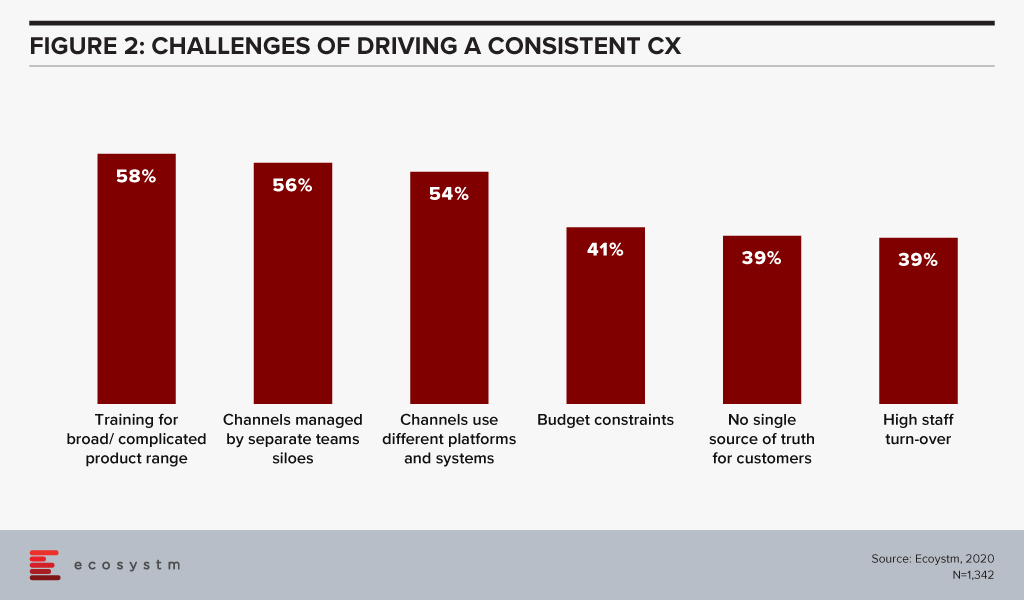

Ecosystm research also finds that organisations find siloed organisational data as one of the biggest challenges in driving consistent customer experience.

This has been further exacerbated by the high volume of interactions that organisations have been having with their customers, and the need to accommodate work-from-home policies for their customer care agents. At the same time, nearly 60% of organisations want to drive an omni-channel experience to improve CX. This provides a huge opportunity for contact centre vendors and partners to offer consulting services to help organisations bridge the gaps in achieving an omni-channel experience. For many organisations there has been a greater push to integrate CRM, the voice of the customer/surveys, customer journey analytics to the contact centre technologies and this is not an easy task as it involves different stakeholders with different sets of KPIs. Having a single platform that can manage this omni-channel experience will be a huge benefit for many organisations.

New Players in the Competitive Landscape

AWS is a relatively new player in the contact centre market, but it is starting to disrupt the existing players, with a global installed base. However, it is worth noting that Avaya, Cisco and Genesys have a higher installed base and they continue to win new deals. The move to the cloud is witnessing more service providers, telecom providers and other contact centre partners push more cloud-based solutions in the market. Apart from AWS, other important players include NICEinContact, 8×8, Talkdesk, Twillio, Five9, and UJet. The competitive battleground is heating up and there are a lot of options for customers to choose from. It will all come down to working with a vendor that can help them achieve their desired CX outcomes.

There are other important elements in CX that are growing in importance and these include conversational AI, voice biometrics, knowledge management systems, machine learning and CX management solutions. Contact centre solution providers are having discussions around these areas with tech buyers. This will mean that we can expect deeper partnerships and acquisitions in the short to medium term. Security has also emerged as an important issue to be resolved, especially with agents working from home. This is from a compliance perspective and pertaining to how agents are viewing and handling customer data. These new trends indicate that customers will need to work with different vendors to solve the variety of issues they are facing.

The Vodafone Connect solution on AWS Connect is one of the many examples of how more partners of contact centre solutions are gearing up for the rapid move to the cloud. Globally, Vodafone also sells contact centre solutions from Cisco and Genesys. The next 3 years will see a great movement in the market and this will include vendors from North America that will set up operations to push their offerings across Europe and the Asia Pacific.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

On December 18, AWS launched Amazon Connect in ASEAN from the Singapore region. I was invited to the ASEAN launch of Connect in Singapore 3 weeks ago where Pasquale DeMaio, GM of Amazon Connect and Robert Killory, ASEAN Solutions Lead presented to analysts.

Pasquale told the audience that the Amazon Connect solution used today has been built over 10 years ago to serve Amazon’s internal needs of servicing millions of customer interactions for their e-commerce transactions. At that time Amazon could not find a solution that was pure cloud-based, cost-effective, scalable and that was easy to use. Since launching Amazon Connect a few years ago, AWS has seen not just small and medium enterprises using Connect – larger organisations have embraced the solution as well.

Amazon Connect has a list of notable clients – Intuit, Rackspace, John Hancock, CapitalOne, GE Appliances, Subway and many others. Intuit, as an example, has had difficulties running experiments in the past and proofs of concept were expensive, complex and time-consuming. With Amazon Connect these run on a test environment allowing their engineers to experiment and if they do not work out, it does not cost Intuit a lot of money to spin up a proof of concept. Philippines telecommunications provider, Globe Telecom wanted to automate and improve their services for their broadband and residential services. It was taking about 2-3 days from payment to the restoration of services. Amazon Connect was deployed to solve this problem by understanding the customer data when calls came through to the contact centre and by using APIs and the Connect suite of applications, there was deep integration with the CRM systems and other platforms that held various pools of data. This produced a faster and scalable way of integrating the payment process and customer service.

The demo of the solution showcased how features such as Amazon Lex can build conversational interfaces for an organisation’s applications powered by the same deep learning technologies like Alexa. With Amazon Lex and Polly, organisations can now build a chatbot without knowing or understanding code.

The Amazon Connect Solution – scaling to become more feature-rich

At ReInvent in Las Vegas in December 2019, Andy Jassy the CEO of AWS unveiled a new offering for their contact centre customers called Contact Lens. The solution is a set of machine learning capabilities integrated into Amazon Connect. The service can be activated through a single click in Connect and can analyse, transcribe calls including previously recorded calls. Jassy also talked about how it allows users to determine the sentiment of the call, pick up on long periods of silence, and times when an agent and customer are talking over the top of each other. These additions can help supervisors understand the challenges faced by agents that can then be addressed during training and coaching sessions. The machine learning models that power Contact Lens for Amazon Connect have been trained specifically to understand the nuances of contact centre conversations including multiple languages and custom vocabularies.

Several other announcements have also been made recently:

- Web and Mobile Chat for customers is a single unified contact centre service for voice and chat. Agents have a single user interface for both voice and chat, reducing the number of screens they have to interact with.

- Amazon Transcribe now supports 31 languages including Indonesian, Malay, Japanese, Korean, and several Indian languages. These are important languages as they expand further across ASEAN and the rest of Asia, given the diversity of languages spoken in the region. Contact centres can convert call recordings into text and analyse the data for actionable intelligence.

Deepening their relationship with Salesforce

At Dreamforce 2019 late last year, Salesforce announced that they will be offering AWS telephony and call transcription services with Amazon Connect as part of their Service Cloud call centre solution. The announcement indicates how the CRM world and the contact centre segments are starting to get closer. CRM vendors are starting to realise that whilst they own the agent at the desktop who have access to the CRM solution, the data from the calls and the actual calls are important. Voice/Telephony is also witnessing greater innovation with vendors in the contact centre space applying machine learning and AI to voice so that intelligence is gathered prior to the call coming to the contact centre and the agent is further empowered through prompts that they can apply when speaking to a customer. As CRM integrates deeper with contact centre solutions, the tight integration between these two solutions cannot be ignored. Salesforce is partnering to innovate in the voice space by applying machine learning at the core of all they do. This is a big announcement given the sheer size of both companies and how both companies are innovating in the contact centre space.

Cloud Contact Centre is high on the agenda in Asia Pacific

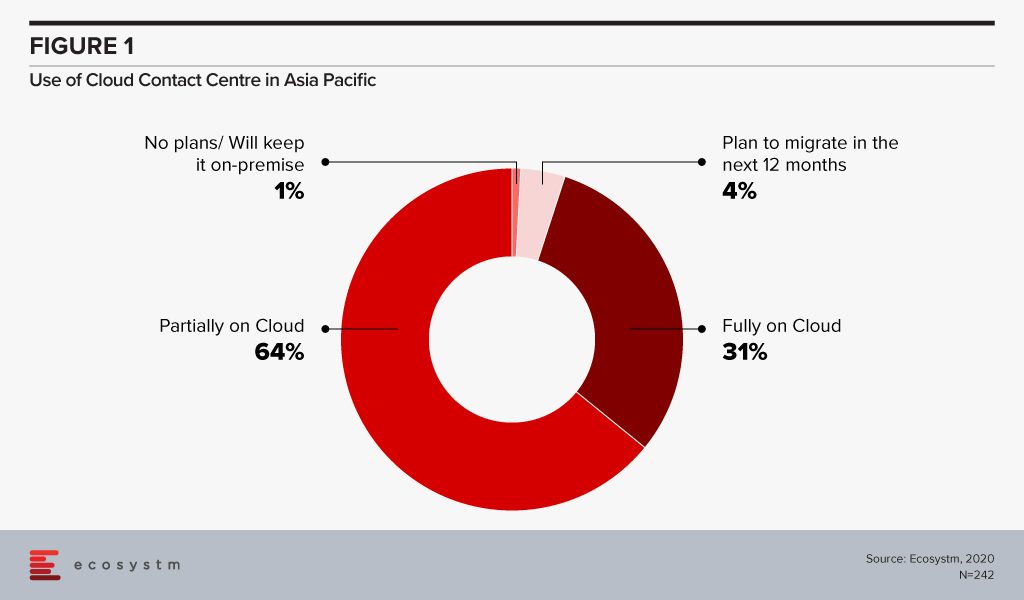

Ecosystm’s CX research finds that most organisations in Asia Pacific are at the inflection point of moving from an on-premise environment to a cloud model. Only 1% of CX decision-makers want to keep their contact centres on-premise – many organisations are evaluating which contact centre vendor they should use to migrate to the cloud. Some countries may see higher adoption than others. Australia and New Zealand have higher cloud contact centre adoption. In ASEAN many organisations are starting to build a wider CX strategy beyond the contact centre including areas such as customer journey analytics and data-driven personalised CX.

Ecosystm comments

In Australia, Amazon Connect has grown its customer base and these include some large enterprises. Big wins in the last 2 years include National Australia Bank and NSW Health. NSW Health shifted its IT service desk and shared services contact centres onto a new cloud-based contact centre platform as part of a broader digital transformation.

AWS has been gearing up for the launch in ASEAN over the last 6 months. The region is very competitive with some long-standing contact centre players having a large share and installed base in the large and medium enterprise accounts. The launch indicates how serious they are about growing their contact centre business in the region. There has been good progress so far in Singapore and the Philippines. Amazon Connect will look to grow its presence in Indonesia, Malaysia, Thailand, and Vietnam in the months to come. The market dynamics in each Asian country is unique and AWS will work with partners such as Accenture, Deloitte, DXC, ECS, NTT and VoiceFoundry to grow their presence in the region. Some of the more traditional partners will need education and upskilling to understand the Amazon Connect value proposition