Ecosystm launches the Trending-Vendor series showcasing the Top 5 disruptive vendors that are shaking up their market segment. Our first Trending-Vendor RNx is focused on Robotic Process Automation (RPA) – Ecosystm research shows that process automation is the biggest driver for tech adoption, with a staggering 127% investment growth in 2021. The Ecosystm RNx – Top 5 Trending-Vendor for RPA evaluates Automation vendors based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an End User and looking to automate your back-end or customer processes, this vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience, integration capabilities, and strategy.

If you are an RPA vendor, you operate in a competitive work with several enterprise vendors vying for a larger share of the pie – this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

ServiceNow announced their intention to acquire robotic process automation (RPA) provider, Intellibot, for an undisclosed sum. Intellibot is a significant tier 2 player in the RPA market, that is rapidly consolidating into the hands of the big three – UiPath, Automation Everywhere, and Blue Prism – and other acquisition-hungry software providers. This is unlikely to be the last RPA acquisition that we see this year with smaller players looking to either go niche or sell out while the market is hot.

Expanding AI/Automation Capabilities

Intellibot is the latest in a string of purchases by ServiceNow that reveals their intention to embed AI and machine learning into offerings. In 2020, they acquired Loom Systems, Passage AI (both January), Sweagle (June), and Element AI (November) in addition to Attivio in 2019. These acquisitions were integrated into the latest version of their Now Platform, code-named Quebec, which was launched earlier this month. As a result, Predictive AIOps and AI Search were newly added to the platform while the low-code tools were expanded upon and became Creator Workflows. This means ServiceNow now offers four primary solutions – IT Workflows, Employee Workflows, Customer Workflows, and Creator Workflows – demonstrating the importance they are placing on low-code and RPA.

ServiceNow was quick to remind the market that although they will be able to offer RPA functionality natively once Intellibot is integrated into their platform, they are still willing to work with competitors. They specifically highlighted that they would continue partnering with UiPath, Automation Anywhere, and Blue Prism, suggesting they plan to use RPA as a complementary technology to their current offerings rather than going head-to-head with the Big Three. Only a month ago, UiPath announced deeper integration with ServiceNow, by expanding automation capabilities for Test Management 2.0 and Agile Development projects.

Expansion in India

The acquisition of Intellibot, based in Hyderabad, is part of ServiceNow’s expansion strategy in India – one of their fastest growing markets. The country is already home to their largest R&D centre outside of the US and they intend to launch a couple of data centres there by March 2022. The company plans to double their local staff levels by 2024, having already tripled the number of employees there in the last two years. The expansion in India means they can increasingly offer services from there to global customers.

Market Consolidation Accelerates

In the Ecosystm Predicts: The Top 5 AI & AUTOMATION Trends for 2021, Ecosystm had talked about technology vendors adding RPA functionality either organically or through acquisitions, this year.

“Buyers will find that many of the automation capabilities that they currently purchase separately will increasingly be integrated in their enterprise applications. This will resolve integration challenges and will be more cost-effective.”

ServiceNow’s purchase is one of several recent examples of low-code vendors acquiring their way into the RPA space. Last year, Appian acquired Novayre Solutions for their Jidoka product and Microsoft snapped up Softomotive. Speculation continues to build that Salesforce could also be assessing RPA targets. Considering RPA market leader, UiPath recently announced that their Series F funding round values the company at USD 35 billion, there is pressure on acquirers to gobble up the remaining smaller players before they are all gone or become prohibitively expensive.

The cloud hyperscalers are also likely to play a growing role in the RPA market over the next year. Microsoft and IBM have already entered the market, coming from the angle of office productivity and business process management (BPM), respectively. Google announced just last week that they will work closely with Automation Anywhere to integrate RPA into their cloud offerings, such as Apigee, AppSheet, and AI Platform. More interestingly, they plan to co-develop new solutions, which might for now satisfy Google’s appetite for RPA rather than requiring an acquisition.

Here are some of the trends to watch for RPA, AI and Automation in 2021. Signup for Free to download Ecosystm’s Top 5 AI & Automation Trends Report.

This week at Microsoft Ignite, there was a heavy emphasis on RPA and low code as the tools it sees as the future of productivity. It used its annual conference for developers and IT professionals to make a slew of announcements about its Power Platform. Most notable is that from this week, Power Automate Desktop will be bundled with Microsoft Windows and is available as a free download. This marks a major step in the direction of mass adoption of RPA.

By Microsoft’s estimates, 50% of tasks carried out by information workers could be automated by currently available technology but are instead performed manually. Moreover, 500 million apps will need to be built by 2026, more than were developed in the last 40 years. Slowing down the pace of automation and the roll out of apps to enable digital business, is the skills gap, with a shortage of 1 million developers in the US alone. This is of course why Microsoft is betting on RPA and low code tools to empower citizen developers to do it themselves.

Microsoft was arguably slow to focus on RPA and low code considering its breadth of applications and good standing with developers. It only announced the general availability of UI Flows in Power Automate less than a year ago. Moreover, its automation suite worked best in the Microsoft universe but had limited interoperability with third-party tools. In May 2020, it acquired Softomotive, which signalled that it was taking RPA seriously and was willing to expand beyond the automation of its own software. By then, acquiring one of the big three – UiPath, Automation Anywhere, or Blue Prism – would have been excessively costly but Softomotive ensured it had both attended and unattended RPA capabilities to build upon. Softomotive’s WinAutomation remerged as Power Automate Desktop in September and with this week’s announcement, it becomes a native component in Windows.

By providing Power Automate Desktop for free with Windows, Microsoft appears to be attempting to generate interest from users who may not have previously been exposed to RPA. For the widespread adoption of RPA beyond just functions like finance, HR, and procurement, these tools need to be put into the hands of average users that can find their own use cases. Eventually, some of these basic users will need more advanced functionality available in the cloud-based version of Power Automate. Microsoft has a range of pricing plans including per user, per flow, with AI Builder, and unattended RPA.

Security and Governance

While making free desktop-based automation available to all, may be an effective means of raising the profile of RPA, Microsoft realises that it must provide IT and security teams with tools for control. It also announced this week additional features, such as:

- Endpoint filtering to turn on selected connections but with restrictions

- Connector action controls, e.g. allowing read permission but not write in some connectors

- Tenant isolation to provide differentiated access to connectors according to business unit

- Usage dashboards

Power Fx – Microsoft’s Low Code Language

Microsoft is one of the best-placed vendors to address the needs of citizen developers; bringing together its dominance as a productivity software provider and an important part of the developer ecosystem. This week it also introduced Power Fx, a low-code programming language based on Microsoft Excel. The logic of this new, simple language should be familiar to the millions of spreadsheet users. Power Fx provides more advanced citizen developers with a bridge from the drag-and-drop features of the Power Platform to low-code development.

Is 2021 the year RPA finally goes mainstream?

Microsoft’s announcements this week are one of many signs in the last few months that the RPA market is on its way to gaining mainstream acceptance. Also garnering attention was the lofty valuation given to the market leader, UiPath, this year. It recently announced that in its Series F funding round, it closed at $750M, valuing the company at $35B. This is hot on the heels of confirmation that it plans to IPO, probably in the first half of 2021. Last year was also a rapid period of consolidation, with Appian, IBM, and Microsoft all making RPA acquisitions. It seems highly likely that in the next few months we could see acquisitions or RPA launches by some of the cloud and application vendors that have until now been waiting to see the technology mature.

How will RPA be a part of your automation strategy in 2021? The Top 5 AI & Automation Trends for 2021 are available for download from the Ecosystm platform. Signup for Free to download the report.

The pandemic crisis has rapidly accelerated digitalisation across all industries. Organisations have been forced to digitalise entire processes more rapidly, as face-to-face engagement becomes restricted or even impossible.

The most visible areas where face-to-face activity is being swiftly replaced by digital alternatives include conferencing and collaboration, and the use of digital channels to engage with customers, suppliers, and other stakeholders.

For example, the crisis has made it difficult – even impossible, sometimes – for contact centre agents to physically work in contact centres, and they often do not have the tools to work effectively from home. This challenge is particularly apparent for offshore contact centres in the Philippines and India. The creation of chatbots has reduced the need for customer service staff and enabled data to by entered into front-office systems, and analysed immediately.

Less visible are back-office processes which are commonly inefficient and labour-intensive. Remote working makes some back-office workflows challenging or impossible. For example, some essential finance and accounting workflows involve a mix of digital communications, printing, scanning, copying and storage of physical documents – making these workflows inefficient, difficult to scale and labour-intensive. This has been highlighted during the pandemic. RPA adoption has grown faster than expected as organisations seek to resolve these and other challenges – often caused by inefficient workflows being scrambled by the crisis.

The RPA Market in Asia Pacific

There are many definitions of the RPA market, but it can broadly be defined as the use of software bots to execute processes which involve high volumes of repeatable tasks, that were previously executed by humans. When processes are automated, the physical location of employees and other stakeholders becomes less important. RPA makes these processes more agile and flexible and makes businesses more resilient. It can also increase operational efficiency, drive business growth, and enhance customer and employee experience.

RPA is a comparatively new and fast-growing market – this is leading to rapid change. In its infancy, it was basically the digitalisation of BPO. It was viewed as a way of automating repetitive tasks, many of which had been outsourced. While its cost saving benefits remain important as with BPOs, customers are now seeking more. They want RPA to help them to improve or transform front-office, back-office and industry-specific processes throughout the organisation. RPA vendors are addressing these enhanced requirements by blending RPA with AI and re-branding their offerings as intelligent automation or hyper-automation.

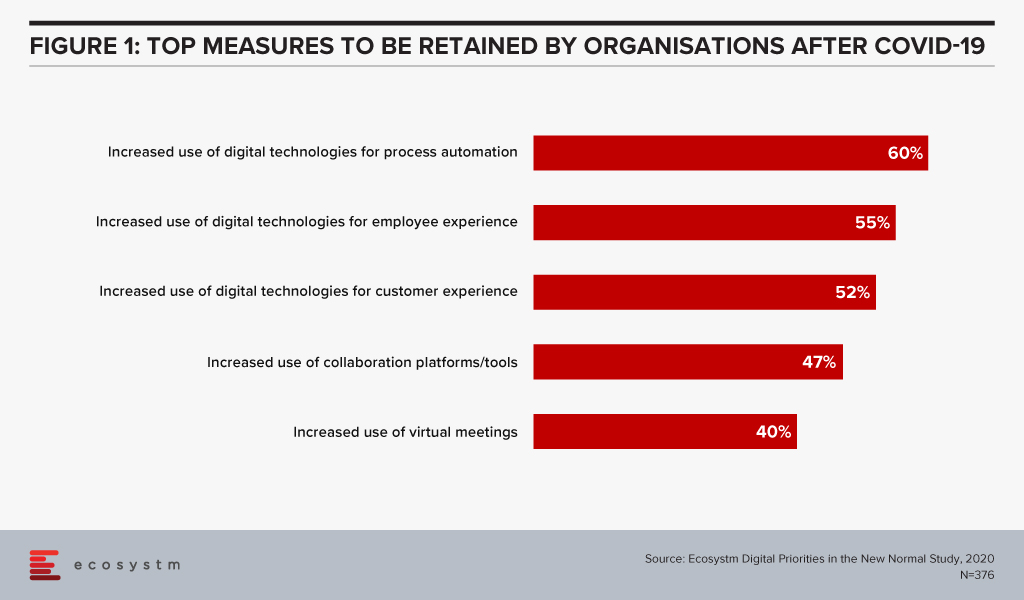

Asia Pacific organisations have been relatively slow to adopt RPA, but this is changing fast. The findings of the Ecosystm Digital Priorities in the New Normal study show that in the next 12 months, organisations will continue to focus on digital technologies for process automation (Figure 1).

The market is growing rapidly with large global RPA specialists such as UiPath, Automation Anywhere, Blue Prism and AntWorks experiencing high rates of growth in the region.

RPA vendors in Asia Pacific, are typically addressing immediate, short-term requirements. For example, healthcare companies are automating the reporting of COVID-19 tests and ordering supplies. Chatbots are being widely used to address unprecedented call centre volumes for airlines, travel companies, banks and telecom providers. Administrative tasks increasingly require automation as workflows become disrupted by remote working.

Companies can also be expected to scale their current deployments and increase the rate at which AI capabilities are integrated into their offerings

RPA often works in conjunction with major software products provided by companies such as Salesforce, SAP, Microsoft and IBM. For example, some invoicing processes involve the use of Salesforce, SAP and Microsoft products. Rather than having an operative enter data into multiple systems, a bot can be created to do this.

Large software vendors such as IBM, Microsoft, Salesforce and SAP are taking advantage of this opportunity by trying to own entire workflows. They are increasingly integrating RPA into their offerings as well as competing directly in the RPA market with pureplay RPA vendors. RPA may soon be integrated into larger enterprise applications, unless pureplay RPA vendors can innovate and continually differentiate their offerings.