Over the past year of moderating AI roundtables, I’ve had a front-row seat to how the conversation has evolved. Early discussions often centred on identifying promising use cases and grappling with the foundational work, particularly around data readiness. More recently, attention has shifted to emerging capabilities like Agentic AI and what they mean for enterprise workflows. The pace of change has been rapid, but one theme has remained consistent throughout: ROI.

What’s changed is the depth and nuance of that conversation. As AI moves from pilot projects to core business functions, the question is no longer just if it delivers value, but how to measure it in a way that captures its true impact. Traditional ROI frameworks, focused on immediate, measurable returns, are proving inadequate when applied to AI initiatives that reshape processes, unlock new capabilities, and require long-term investment.

To navigate this complexity, organisations need a more grounded, forward-looking approach that considers not only direct gains but also enablement, scalability, and strategic relevance. Getting this right is key to both validating today’s investments and setting the stage for meaningful, sustained transformation.

Here is a summary of the key thoughts around AI ROI from multiple conversations across the Asia Pacific region.

1. Redefining ROI Beyond Short-Term Wins

A common mistake when adopting AI is using traditional ROI models that expect quick, obvious wins like cutting costs or boosting revenue right away. But AI works differently. Its real value often shows up slowly, through better decision-making, greater agility, and preparing the organisation to compete long-term.

AI projects need big upfront investments in things like improving data quality, upgrading infrastructure, and managing change. These costs are clear from the start, while the bigger benefits, like smarter predictions, faster processes, and a stronger competitive edge, usually take years to really pay off and aren’t easy to measure the usual way.

Ecosystm research finds that 60% of organisations in Asia Pacific expect to see AI ROI over two to five years, not immediately.

The most successful AI adopters get this and have started changing how they measure ROI. They look beyond just money and track things like explainability (which builds trust and helps with regulations), compliance improvements, how AI helps employees work better, and how it sparks new products or business models. These less obvious benefits are actually key to building strong, AI-ready organisations that can keep innovating and growing over time.

2. Linking AI to High-Impact KPIs: Problem First, Not Tech First

Successful AI initiatives always start with a clearly defined business problem or opportunity; not the technology itself. When a precise pain point is identified upfront, AI shifts from a vague concept to a powerful solution.

An industrial firm in Asia Pacific reduced production lead time by 40% by applying AI to optimise inspection and scheduling. This result was concrete, measurable, and directly tied to business goals.

This problem-first approach ensures every AI use case links to high-impact KPIs – whether reducing downtime, improving product quality, or boosting customer satisfaction. While this short-to-medium-term focus on results might seem at odds with the long-term ROI perspective, the two are complementary. Early wins secure executive buy-in and funding, giving AI initiatives the runway needed to mature and scale for sustained strategic impact.

Together, these perspectives build a foundation for scalable AI value that balances immediate relevance with future resilience.

3. Tracking ROI Across the Lifecycle

A costly misconception is treating pilot projects as the final success marker. While pilots validate concepts, true ROI only begins once AI is integrated into operations, scaled organisation-wide, and sustained over time.

Ecosystm research reveals that only about 32% of organisations rigorously track AI outcomes with defined success metrics; most rely on ad-hoc or incomplete measures.

To capture real value, ROI must be measured across the full AI lifecycle. This includes infrastructure upgrades needed for scaling, ongoing model maintenance (retraining and tuning), strict data governance to ensure quality and compliance, and operational support to monitor and optimise deployed AI systems.

A lifecycle perspective acknowledges the real value – and hidden costs – emerge beyond pilots, ensuring organisations understand the total cost of ownership and sustained benefits.

4. Strengthening the Foundations: Talent, Data, and Strategy

AI success hinges on strong foundations, not just models. Many projects fail due to gaps in skills, data quality, or strategic focus – directly blocking positive ROI and wasting resources.

Top organisations invest early in three pillars:

- Data Infrastructure. Reliable, scalable data pipelines and quality controls are vital. Poor data leads to delays, errors, higher costs, and compliance risks, hurting ROI.

- Skilled Talent. Cross-functional teams combining technical and domain expertise speed deployment, improve quality, reduce errors, and drive ongoing innovation – boosting ROI.

- Strategic Roadmap. Clear alignment with business goals ensures resources focus on high-impact projects, secures executive support, fosters collaboration, and enables measurable outcomes through KPIs.

Strengthening these fundamentals turns AI investments into consistent growth and competitive advantage.

5. Navigating Tool Complexity: Toward Integrated AI Lifecycle Management

One of the biggest challenges in measuring AI ROI is tool fragmentation. The AI lifecycle spans multiple stages – data preparation, model development, deployment, monitoring, and impact tracking – and organisations often rely on different tools for each. MLOps platforms track model performance, BI tools measure KPIs, and governance tools ensure compliance, but these systems rarely connect seamlessly.

This disconnect creates blind spots. Metrics sit in silos, handoffs across teams become inefficient, and linking model performance to business outcomes over time becomes manual and error prone. As AI becomes more embedded in core operations, the need for integration is becoming clear.

To close this gap, organisations are adopting unified AI lifecycle management platforms. These solutions provide a centralised view of model health, usage, and business impact, enriched with governance and collaboration features. By aligning technical and business metrics, they enable faster iteration, responsible scaling, and clearer ROI across the lifecycle.

Final Thoughts: The Cost of Inaction

Measuring AI ROI isn’t just about proving cost savings; it’s a shift in how organisations think about value. AI delivers long-term gains through better decision-making, improved compliance, more empowered employees, and the capacity to innovate continuously.

Yet too often, the cost of doing nothing is overlooked. Failing to invest in AI leads to slower adaptation, inefficient processes, and lost competitive ground. Traditional ROI models, built for short-term, linear investments, don’t account for the strategic upside of early adoption or the risks of falling behind.

That’s why leading organisations are reframing the ROI conversation. They’re looking beyond isolated productivity metrics to focus on lasting outcomes: scalable governance, adaptable talent, and future-ready business models. In a fast-evolving environment, inaction carries its own cost – one that may not appear in today’s spreadsheet but will shape tomorrow’s performance.

Consider the sheer volume of information flowing through today’s financial systems: every QR payment, e-KYC onboarding, credit card swipe, and cross-border transfer captures a data point. With digital banking and Open Banking, financial institutions are sitting on a goldmine of insights. But this isn’t just about data collection; it’s about converting that data into strategic advantage in a fast-moving, customer-driven landscape.

With digital banks gaining traction and regulators around the world pushing bold reforms, the industry is entering a new phase of financial innovation powered by data and accelerated by AI.

Ecosystm gathered insights and identified key challenges from senior banking leaders during a series of roundtables we moderated across Asia Pacific. The conversations revealed a clear picture of where momentum is building – and where obstacles continue to slow progress. From these discussions, several key themes emerged that highlight both opportunities and ongoing barriers in the Banking sector.

1. AI is Leading to End-to-End Transformation

Banks are moving beyond generic digital offerings to deliver hyper-personalised, data-driven experiences that build loyalty and drive engagement. AI is driving this shift by helping institutions anticipate customer needs through real-time analysis of behavioural, transactional, and demographic data. From pre-approved credit offers and contextual investment nudges to app interfaces that adapt to individual financial habits, personalisation is becoming a core strategy, not just a feature. This is a huge departure from reactive service models, positioning data as a long-term strategic asset.

But the impact of AI isn’t limited to customer-facing experiences. It’s also driving innovation deep within the banking stack, from fraud detection and SME loan processing to intelligent chatbots that scale customer support. On the infrastructure side, banks are investing in agile, AI-ready platforms to support automation, model training, and advanced analytics at scale. These shifts are redefining how banks operate, make decisions, and deliver value. Institutions that integrate AI across both front-end journeys and back-end processes are setting a new benchmark for agility, efficiency, and competitiveness in a fast-changing financial landscape.

2. Regulatory Shifts are Redrawing the Competitive Landscape

Regulators are moving quickly in Asia Pacific by introducing frameworks for Open Banking, real-time payments, and even AI-specific standards like Singapore’s AI Verify. But the challenge for banks isn’t just keeping up with evolving external mandates. Internally, many are navigating a complicated mix of overlapping policies, built up over years of compliance with local, regional, and global rules. This often slows down innovation and makes it harder to implement AI and automation consistently across the organisation.

As banks double down on AI, it is clear that governance can’t be an afterthought. Many are still dealing with fragmented ownership of AI systems, inconsistent oversight, and unclear rules around things like model fairness and explainability. The more progressive ones are starting to fix this by setting up centralised governance frameworks, investing in risk-based controls, and putting processes in place to monitor things like bias and model drift from day one. They are not just trying to stay compliant; they are preparing for what’s coming next. In this landscape, the ability to manage regulatory complexity with speed and clarity, both internally and externally, is quickly becoming a competitive edge.

3. Success Depends on Strategy, Not Just Tech

While enthusiasm for AI is high, sustainable success hinges on a clear, aligned strategy that connects technology to business outcomes. Many banks struggle with fragmented initiatives because they lack a unified roadmap that prioritises high-impact use cases. Without clear goals, AI projects often fail to deliver meaningful value, becoming isolated pilots with limited scalability.

To avoid this, banks need to develop robust return-on-investment (ROI) models tailored to their context — measuring benefits like faster credit decisioning, reduced fraud losses, or increased cross-selling effectiveness. These models must consider not only the upfront costs of infrastructure and talent, but also ongoing expenses such as model retraining, governance, and integration with existing systems.

Ethical AI governance is another essential pillar. With growing regulatory scrutiny and public concern about opaque “black box” models, banks must embed transparency, fairness, and accountability into their AI frameworks from the outset. This goes beyond compliance; strong governance builds trust and is key to responsible, long-term use of AI in sensitive, high-stakes financial environments.

4. Legacy Challenges Still Hold Banks Back

Despite strong momentum, many banks face foundational barriers that hinder effective AI deployment. Chief among these is data fragmentation. Core customer, transaction, compliance, and risk data are often scattered across legacy systems and third-party platforms, making it difficult to access the integrated, high-quality data that AI models require.

This limits the development of comprehensive solutions and makes AI implementations slower, costlier, and less effective. Instead of waiting for full system replacements, banks need to invest in integration layers and modern data platforms that unify data sources and make them AI-ready. These platforms can connect siloed systems – such as CRM, payments, and core banking – to deliver a consolidated view, which is crucial for accurate credit scoring, personalised offers, and effective risk management.

Banks must also address talent gaps. The shortage of in-house AI expertise means many institutions rely on external consultants, which increases costs and reduces knowledge transfer. Without building internal capabilities and adjusting existing processes to accommodate AI, even sophisticated models may end up underused or misapplied.

5. Collaboration and Capability Building are Key Enablers

AI transformation isn’t just a technology project – it’s an organisation-wide shift that requires new capabilities, ways of working, and strategic partnerships. Success depends on more than just hiring data scientists. Relationship managers, credit officers, compliance teams, and frontline staff all need to be trained to understand and act on AI-driven insights. Processes such as loan approvals, fraud escalations, and customer engagement must be redesigned to integrate AI outputs seamlessly.

To drive continuous innovation, banks should establish internal Centres of Excellence for AI. These hubs can lead experimentation with high-value use cases like predictive credit scoring or real-time fraud detection, while ensuring that learnings are shared across business units. They also help avoid duplication and promote strategic alignment.

Partnerships with fintechs, technology providers, and academic institutions play a vital role as well. These collaborations offer access to cutting-edge tools, niche expertise, and locally relevant AI models that reflect the regulatory, cultural, and linguistic contexts banks operate in. In a fast-moving and increasingly competitive space, this combination of internal capability building and external collaboration gives banks the agility and foresight to lead.

AI is not just reshaping how businesses operate — it’s redefining the CFO’s role at the centre of value creation, risk management, and operational leadership.

As stewards of capital, CFOs must cut through the hype and ensure AI investments deliver measurable business returns. As guardians of risk and compliance, they must shield their organisations from new threats — from algorithmic bias to data privacy breaches with heavy financial and reputational costs. And as leaders of their function, CFOs now have a generational opportunity to modernise finance, champion AI adoption, and build teams ready for an AI-powered future.

LEAD WITH RIGOUR. SAFEGUARD WITH VIGILANCE. CHAMPION WITH VISION.

That’s the CFO playbook for AI success.

Click here to download “AI Stakeholders: The Finance Perspective” as a PDF.

1. Investor & ROI Gatekeeper: Ensuring AI Delivers Value

CFOs must scrutinise AI investments with the same discipline as any major capital allocation.

- Demand Clear Business Cases. Every AI initiative should articulate the problem solved, expected gains (cost, efficiency, accuracy), and specific KPIs.

- Prioritise Tangible ROI. Focus on AI projects that show measurable impact. Start with high-return, lower-risk use cases before scaling.

- Assess Total Cost of Ownership (TCO). Go beyond upfront costs – factor in integration, maintenance, training, and ongoing AI model management.

Only 37% of Asia Pacific organisations invest in FinOps to cut costs, boost efficiency, and strengthen financial governance over tech spend.

2. Risk & Compliance Steward: Navigating AI’s New Risk Landscape

AI brings significant regulatory, compliance, and reputational risks that CFOs must manage – in partnership with peers across the business.

- Champion Data Quality & Governance. Enforce rigorous data standards and collaborate with IT, risk, and business teams to ensure accuracy, integrity, and compliance across the enterprise.

- Ensure Data Accessibility. Break down silos with CIOs and CDOs and invest in shared infrastructure that AI initiatives depend on – from data lakes to robust APIs.

- Address Bias & Safeguard Privacy. Monitor AI models to detect bias, especially in sensitive processes, while ensuring compliance.

- Protect Security & Prevent Breaches. Strengthen defences around financial and personal data to avoid costly security incidents and regulatory penalties.

3. AI Champion & Business Leader: Driving Adoption in Finance

Beyond gatekeeping, CFOs must actively champion AI to transform finance operations and build future-ready teams.

- Identify High-Impact Use Cases. Work with teams to apply AI where it solves real pain points – from automating accounts payable to improving forecasting and fraud detection.

- Build AI Literacy. Help finance teams see AI as an augmentation tool, not a threat. Invest in upskilling while identifying gaps – from data management to AI model oversight.

- Set AI Governance Frameworks. Define accountability, roles, and control mechanisms to ensure responsible AI use across finance.

- Stay Ahead of the Curve. Monitor emerging tech that can streamline finance and bring in expert partners to fast-track AI adoption and results.

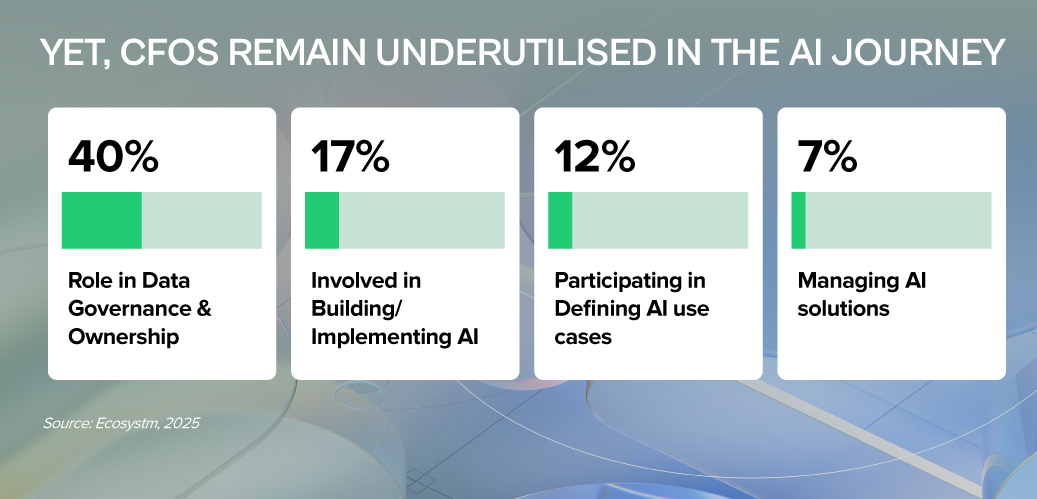

CFOs: From Gatekeepers to Growth Drivers

AI is not just a tech shift – it’s a CFO mandate. To lead, CFOs must embrace three roles: Investor, ensuring every AI bet delivers real ROI; Risk Guardian, protecting data integrity and compliance in a world of new risks; and AI Champion, embedding AI into finance teams to boost speed, accuracy, and insight.

This is how finance moves from record-keeping to value creation. With focused leadership and smart collaboration, CFOs can turn AI from buzzword to business impact.

The Asia Pacific region is rapidly emerging as a global economic powerhouse, with AI playing a key role in driving this growth. The AI market in the region is projected to reach USD 244B by 2025, and organisations must adapt and scale AI effectively to thrive. The question is no longer whether to adopt AI, but how to do so responsibly and effectively for long-term success.

The APAC AI Outlook 2025 highlights how Asia Pacific enterprises are moving beyond experimentation to maximise the impact of their AI investments.

Here are 5 key trends that will impact the AI landscape in 2025.

Click here to download “The Future of AI-Powered Business: 5 Trends to Watch” as a PDF.

1. Strategic AI Deployment

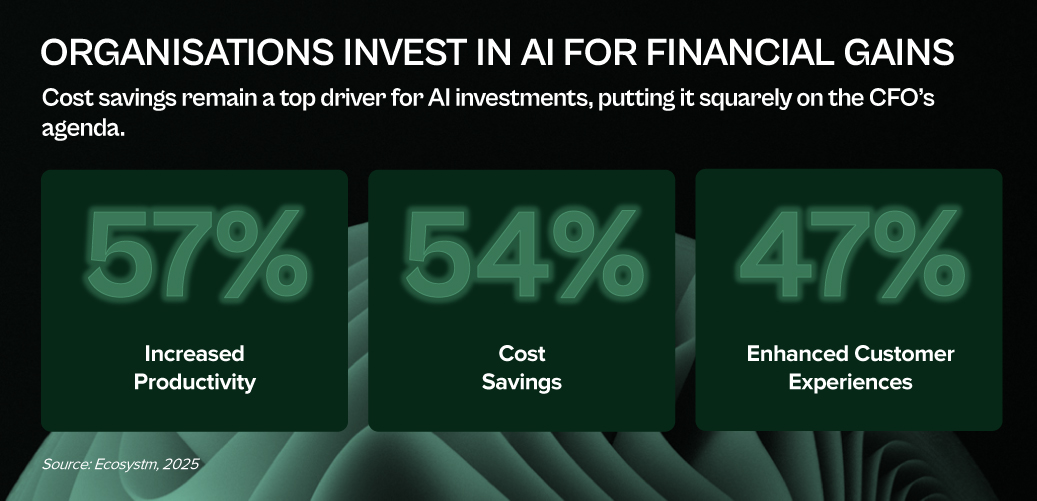

AI is no longer a buzzword, but Asia Pacific’s transformation engine. It’s reshaping industries and fuelling growth. Initially, high costs and complex ROI pushed leaders toward quick wins. Now, the game has changed. As AI adoption matures, the focus is shifting from short-term gains to long-term, innovation-driven strategies.

GenAI is is at the heart of this shift, moving beyond the periphery to power core business functions and deliver competitive advantage.

Organisations are rethinking AI investments, looking beyond pure financials to consider the impact on jobs, governance, and data readiness. The AI journey is about balancing ambition with practicality.

2. Optimising AI: Tailored Open-Source Models

Smaller, open-source, and specialised AI models will gain momentum as organisations seek efficiency, flexibility, and sustainability in their AI strategies.

Unlike LLMs, which require high computational power, smaller, task-specific models offer comparable performance while being more resource-efficient. This makes them ideal for organisations working with proprietary data or limited computational resources.

Beyond cost and performance, these models are more energy-efficient, addressing growing concerns about AI’s environmental impact.

3. Centralised Tools for Responsible Innovation

Navigating the increasingly complex AI landscape demands unified management and governance. Organisations will prioritise centralised frameworks to tame the chaos of diverse AI solutions, ensuring compliance (think EU AI Act) while boosting transparency and security.

Automated AI lifecycle management tools will streamline oversight, providing real-time tracking of model performance, usage, and issues like drift.

By using flexible developer toolkits and vendor-agnostic strategies, organisations can accelerate innovation while maintaining adaptability, as the technology evolves.

4. Supercharging Workflows With Agentic AI

Organisations will embrace Agentic AI to automate complex workflows and drive business value. Traditional automation tools struggle with real-world dynamism, but AI-powered agents offer a flexible solution. They empower autonomous task execution, intelligent decision-making, and adaptability to changing circumstances.

These agents, often using GenAI, understand complex instructions and learn from experience. They collaborate with humans, boosting efficiency, and adapt to disruptions, unlike rigid traditional automation.

Agentic workflows are key to redefining work, enabling agility and innovation.

5. From Productivity to People

The focus of AI conversations will shift from simply boosting productivity to using AI for human-centric innovation that transforms both employee roles and customer experiences.

For employees, AI will handle routine tasks, enabling them to focus on creativity and innovation. Education and training will be crucial for a smooth transition to AI-powered workflows.

For customers, AI is evolving to offer more empathetic, personalised interactions by understanding individual emotions, motivations, and preferences. Organisations are recognising the need for transparent, explainable AI to build trust, tailor solutions, and deepen engagement.

Hit or miss AI experiments have leaders demanding results. In this breakneck AI landscape, strategy and realism are your survival tools. A pragmatic approach? High-impact, achievable goals. Know your capabilities, prioritise manageable projects, and stay flexible. The AI winners will be those who champion human-AI collaboration, bake in ethics, and never stop researching.