I was a guest last week at the NICE Interactions Summit in Sydney and it was great to hear from executives from NICE talk about the journey the company is taking their customers on. Australia and New Zealand are witnessing good adoption of cloud contact centres and many organisations (as covered in some of previous blogs) are at the inflection point of investing in a cloud contact centre, machine learning, customer journey mapping and predictive analytics technologies to drive greater customer experience (CX). Across Asia Pacific and in the ASEAN region, more organisations are at the verge of embarking on transformational CX projects to help them raise the bar on CX in a highly competitive environment. We can expect the adoption of cloud contact centres to grow rapidly in the next few years across the Asia Pacific region as companies move from expensive and traditional legacy environments to agile platforms.

Investing in Analytics and Cloud

Darren Rushworth, NICE’s Managing Director APAC, talked about how NICE has moved from being an infrastructure player to become an analytics company and talked about the acquisitions that are helping them alleviate their game in CX. Key acquisitions since 2016 have been instrumental to shaping their offerings and these include Nexidia, an Interaction Analytics software company and InContact, a cloud contact centre vendor. In 2019 NICE acquired Brand Embassy, whose technology brings to CXone a full range of integrated channels, enabling any digital channel to be integrated into customer service operations. In a Mobile First economy where customers want the applications of their choice, allowing customers to use the social media or messaging application of their choice in their contact centre interactions, will be critical. The Brand Embassy platform supports more than 30 channels and these include Facebook Messenger, Twitter, Apple Business Chat, WhatsApp, LinkedIn, SMS, email, and live chat. This is an important acquisition and not many contact centres have addressed the issue of allowing multiple forms of messaging to be used when customers want to communicate an issue or get answer to a query. Customers are gravitating towards social media platforms and messaging apps for daily communication and being able to integrate those channels to the contact centre is important.

The Move to the Cloud with NICEinContact

It was interesting to hear Tracy Duthie, Head of Service Development at 2degrees Mobile talk about why they deployed a NICEinContact solution. She talked about 2degrees having too many legacy systems that were not all integrated. The problems with not having the systems integrated drove the team to think hard about embarking on a journey with NICE. The objective was to grow their market share and to drive greater contact centre efficiency. She mentioned that 2degrees were keen on a SaaS option and it was not just about replacing the legacy solution. The move to the cloud as many organisations are starting to tell me, is to drive transformation and further innovation including deploying agile methodologies to deliver great CX. Also because this was a cloud deployment, they invested heavily in the network. This is an important aspect for an organisation when embarking on a cloud journey especially for mission critical applications such as voice, video and collaboration applications where latency and jitter can spoil the experience. Many times, I have heard customers blame the vendor for the technology. For cloud voice, video and other contact centre applications to work well in real time, the investment in the network must not be compromised especially when working on a tight budget. When this aspect is ignored, the problems discussed early are bound to arise. She also highlighted how important it was to eventually get the agents on board the new deployment and they adopted an open culture of allowing the agents to provide feedback and an open dialogue was initiated. As this was a big change from when they were running the contact centre in a traditional environment, the change management aspect was critical for the agents.

Compliance is something that has to be adhered to seriously

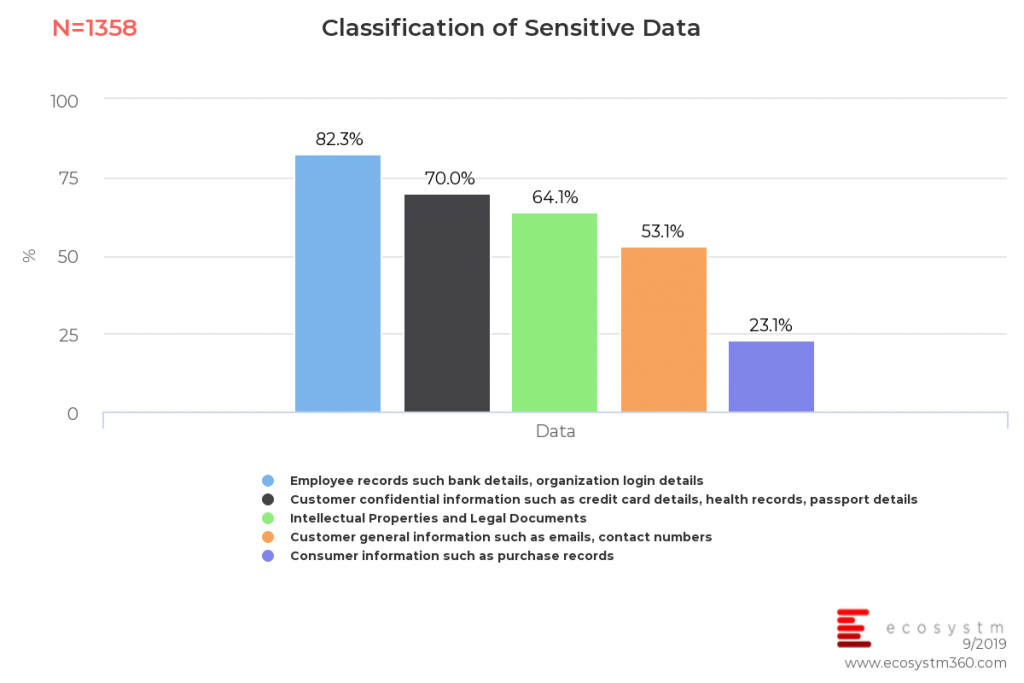

Efrat Kanner-Nissimov from NICE presented on driving a proactive compliance culture. This is a highly talked about area in the contact centre, given the increase in legislation around privacy and all countries having strict legislation around customer data and data privacy. Contact centres store sensitive customer information and knowing when to dispose off that data or for how long the data can be kept is an aspect that cannot be ignored. With what the banks have been through in Australia in recent times with the Royal Commission, serious questions around compliance and how compliant the agents are cannot be ignored. Ecosystm research finds that several organisations fail to identify what could be sensitive information. The journey towards a compliant environment starts with data classification, long before security roadmaps and solution implementations.

There is a greater emphasis on compliance and whilst many contact centres will claim that they have the processes in place, some of these have not been looked at for years. Compliance impacts the IT Manager, the agents, the Supervisor and ultimately the business. An automated compliance solution will help detect violations, prevent errors and allow for better visibility across different systems. She presented how Macy’s claims to have reduced their infrastructure and storage costs by 40%, through automating and deleting interactions that were no longer required. This helped lower IT costs and reduced time on audits. With the emphasis today on data privacy, data storage, data deletion and being compliant when you talk to your customers, the CX agents have a critical role to play in ensuring compliance.

Ecosystm comment:

Organisations across the Asia Pacific region are re-inventing how they look at CX as mentioned in my previous blogs. Banks, airlines, retailers, telcos and organisations from other verticals are investing in projects to drive transformation in CX. Applying deep analytics along every step of a customer’s journey will help the contact centre and the wider organisation better serve customers. The traditional methods of just looking at inbound and outbound interactions and setting KPIs for that, are no longer enough to drive this new vision. Machine learning, customer journey mapping and analytics, as well as shifting to the cloud is needed to drive transformation and agile ways of running CX. The Brand Embassy acquisition is an important one for NICE given one of the challenges not addressed by contact centres is integrating the various social and messaging applications and making them available to customers as a way to interact with the brand. This is an area contact centres have been looking to resolve.

In a highly competitive CX market where CRM, analytics, cloud and machine learning technologies are important aspects of a CX journey, NICE is investing in these areas to further strengthen their cloud contact centre value proposition. Compliance as highlighted earlier cannot be ignored and it is an area contact centres will be looking to invest in due to the multiple strict regulations underway across the Asia Pacific region surrounding how customers data is treated.

Cisco announced their plans to acquire CloudCherry to bolster their contact centre portfolio. Launched in Chennai in 2014, CloudCherry is a customer experience (CX) management startup that helps organisations understand the various factors influencing CX. CloudCherry has employees in Chennai, Bengaluru, Singapore and Malaysia, besides the US and their team of around 90 employees will join Cisco’s contact centre solution practice as part of the acquisition

Using artificial intelligence (AI) as the underlying solution to CloudCherry’s open API platform allows for various customer data sets from CRM systems to other communication touchpoints in the contact centre to be analysed in real-time for the organisation to deliver a personalised CX. When agents can understand what is taking place in real-time and when the contact centre team has one integrated point of data injecting analytics, improving the ability to drive greater loyalty and eventually higher revenues.

Some of CloudCherry’s offerings are:

- Measuring customer journeys. CloudCherry provides the opportunity to follow the customer across 17 different channels, driving contextual real-time conversations with customers on the channels they choose. It is important to understand the micro journeys – for example, their customer PUMA sells products online and in physical stores and may have two micro journeys in addition to an overall customer journey map for:

- Online customers

- In-store customers

- Blended customers

- Predictive Analytics. Their predictive engine is based on customer feedback, their actions and their purchasing data. With advanced predictive analytics, CX teams can derive what is needed to increase the ROI.

- Questionnaire builder. They have the capability to respond to feedback collected from surveys in real-time. There are set conditions for survey questions so that when triggered by customer response, the concerned employee or department is quickly notified regarding it. For instance, when a customer gives a low rating on store cleanliness or staff behaviour, an alert can be immediately sent to the concerned employee to follow up and take corrective action. At the same time, even positive feedback can be noted in order to recognise and reward employees.

- Sentiment Analysis. This helps organisations tap into machine learning and deep learning to identify customer sentiment associated with open-text responses and brand conversations.

These are just some of the applications and tools the CloudCherry platform offers to their customers.

Leading with data will be critical to driving personalised CX

CX decision-makers and buyers of contact centre and CX technologies have an important role to play in the next few years to look at re-inventing how they view CX. This means re-looking at the ways they have been running contact centres in the traditional way and making investments towards the cloud, machine learning and predictive analytics.

- By having rich analytics, mobile conversation through the app can be richer. A Mobile-led CX approach is key in today’s world where most people spend hours on a phone.

- Issues can be prevented before they happen if in-store transactions are monitored and dissatisfied customers can be identified. The organisation has the ability to reach out to the customer through any touchpoint to mention proactively that they are aware of the issues that just happened and what they can do to help solve the negative experience. Proactive notifications demonstrate how a brand takes it, customers, seriously

- Leveraging AI as the underlying platform to understand customer behaviour is going to be the next battleground for CX vendors. The challenge so far has been that many organisations have invested in several data and CRM tools from various vendors. When agents have to view customer information, they are dealing with data in an unsynchronised format. This explains why when we contact a contact centre, we sometimes have to repeat ourselves and state the problem we are facing. Or worse than that, the agent has no idea that we had a problem a week ago and spoke to 2 agents. These frustrations are real and still happen today.

- Contact centre of the future will not be reactive but proactive in helping understand customer sentiment in real-time to make the necessary adjustments and actions needed to solve the issue the customer is facing. The deep analytics platform for CX also means that agents will be empowered with information and bots can be placed to help agents say the right things or make suggestions to customers. The use cases to help deliver personalised CX are enormous.

Ecosystm comment

This is an important and good acquisition for Cisco. Cisco has a vast set of customers globally and in the Asia Pacific region in the collaboration, voice and contact centre space. This acquisition marks how they are investing in enhancing their existing contact centre portfolio to use machine learning, cognitive and predictive analytics to alleviate their offerings. The contact centre is a key part of Cisco’s larger collaboration portfolio.

According to the company, Cisco products support more than 30,000 contact centre customers and more than 3 million contact centre agents around the world. Vasili Triant, VP and GM of Cisco Contact Centre solutions mentioned in a blog recently that the acquisition will augment Cisco’s contact centre portfolio with advanced analytics, journey mapping and sophisticated survey capabilities whether their customers are using Webex Contact Centre in the cloud or their hosted and on-premises solutions.

The market for predictive analytics and customer analytics in the contact centre and across the CX segment will be big and we are at the beginning of a new era of organisations using data as the platform to deliver a new way of engaging with customers. CloudCherry offers a CX management platform that uses predictive analytics to derive insights for contact centre agents. The market for deep analytics is becoming an important area of investment for organisations as a way to decrease customer frustration. It is by applying analytics before, during and after the call that will allow contact centres to deliver a personalised CX as was mentioned in my last blog. This is the reason why a data-driven culture will be key to driving rich outcomes for the contact centre. Contact centres will have to lead with analytics so that every experience across every single touchpoint the customer has with the brand is analysed and observed in real-time. We will see many contact centre vendors and players in the CRM space acquire companies with capabilities like what CloudCherry offers.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

As companies grapple with finding the right balance between managing multiple touchpoints and driving great customer experience (CX), the importance of getting the flow consistent – right communication to the client without spending too much time on re-directing calls or asking questions about a previous call or experience via a touchpoint – is becoming critical. The desire to impress a customer the first time they come into contact with a touchpoint is an area companies are looking to invest in. Using data as a means to understand customer sentiment before the call comes in will give the agent information to prepare them for making appropriate decisions during and after the call.

Case Study – Carsales

I was recently invited to an AWS Connect, Zendesk and Voice Foundry event in Sydney and it was great to hear from Carsales about how they re-invented CX. Prior to making the leap to deploying the solution from AWS Connect and Zendesk, they had been running their contact centre for years using a traditional contact centre platform. Some of the issues they have faced over the years included the following:

- Difficult and costly to customise

- Expensive support costs

- Expensive and difficult integrations

- Difficult to extract reporting

- Downtime for upgrades

- Difficult to use

These issues are common challenges posed by traditional contact centre platforms. High costs of maintenance and expensive integration costs are some of the challenges I hear of when speaking to end-users. The contact centre and CX industry are at an inflection point where organisations are evaluating how best to drive great CX and at the same time considering how to work with vendors that can help drive innovation in CX. Carsales eventually shortlisted 4 players before making the decision on which cloud provider to work with. They ended up working with Zendesk and AWS Connect.

Carsales recognised the need for a CX solution that could use the data they already have on their customers in Zendesk and Salesforce CRM systems to create a unique experience for each interaction. It was important for them to have a solution that would simplify data warehousing and analytics to make it easier to get a full view of the customer. By integrating the CRM application to AWS Connect as the CX orchestration engine. to bring the contact centre and CRM applications together helped Carsales deliver a personalised CX for their customers.

WHY AWS Connect?

These have come off the points mentioned by Carsales as to why they selected AWS Connect:

- Cloud-Based (accessible anywhere)

- No downtime for upgrades

- Access to Data (Lambda and APIs) via ZenDesk and Salesforce

- Easy UI

- Support from implementation partner Voice Foundry

- Affordable solution

- Access to great technology such as Speech to Text (Polly), Speech Recognition (Lex) and Analytics (Transcribe and Comprehend)

- Scalable and customisable call flows

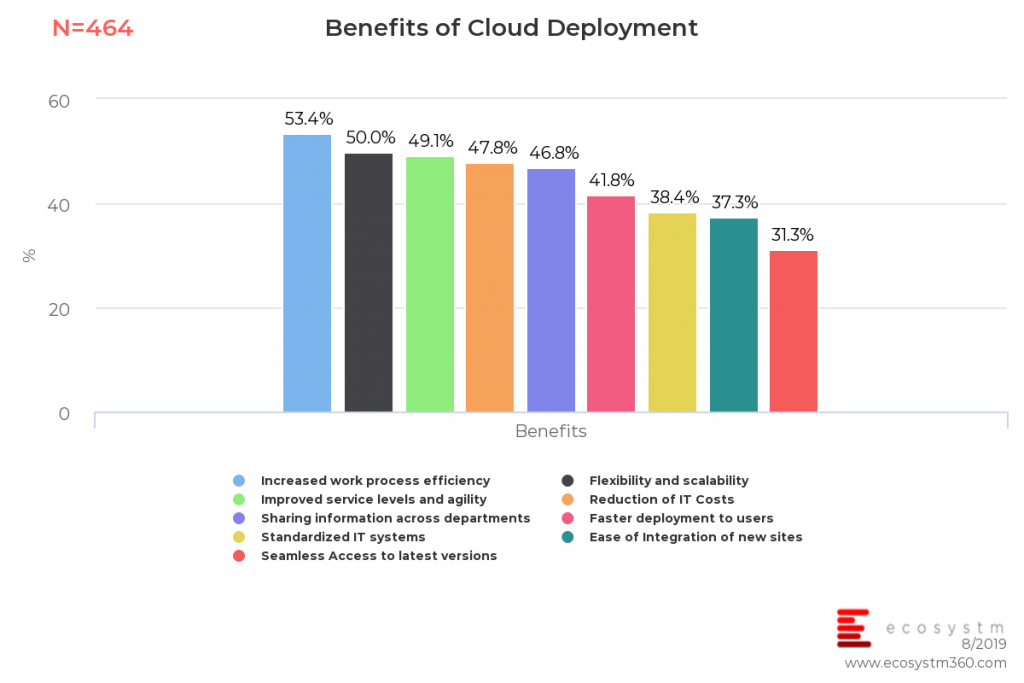

In the global Ecosystm Cloud study, as depicted by the chart below, about 53% of organisations state that increased work processes and efficiency are a key benefit of the cloud. Nearly half the organisations rate flexibility and scalability and improved service levels and agility as the main benefits of a cloud deployment.

Implementation Learnings

What Carsales found about the AWS Connect solution, is how changes can be made easily. Most configurations can be made by the contact centre staff and there is no need to go to IT. Their primary aim was to deliver a personalised CX by accessing data from other internal systems (CRM, proprietary databases, etc) and the solution addressed this need.

The advice that Carsales gives to others implementing a Cloud Contact Centre are:

- Ensure that you have invested in the network to support voice over IP.

- Make sure that your headsets are compatible to ensure full functionality.

- Engage with a partner rather than implementing the platform on your own. Although you can implement AWS Connect solution on your own, it can be difficult. Voice Foundry was a great implementation partner.

The Importance of Data-Driven CX

The market is witnessing a shift where organisations are looking for new and more agile platforms for CX. The challenges, as highlighted by Carsales – such as existing solutions being difficult and costly to customise – are some of the common challenges we are hearing from organisations about the limitations of traditional telephony and contact centre solutions. Whilst the traditional vendors still have a majority share of the market, that is changing. Some of the new cloud contact centre vendors are offering new and dynamic ways of driving a better experience for the users of the technology – from agents to those that manage the contact centre solution. The ability to add agents when needed has become easier (without intervention from IT) and cloud provides better security due to the multiple back-ups and redundancies it offers. The ability to reduce maintenance and customise applications with new agile methodologies and APIs are driving a new era in the contact centre market. The single most important area is deep analytics. The ability to have deep analytics to understand the customer better as a starting point before a call, during a call and after the call is critical. Artificial intelligence can be used to better understand customer sentiment and detect trends in customer data.

The shift from traditional contact centres to cloud contact centres is happening and no longer just with mid-market companies. Large organisations are making the shift to the cloud as the benefits are apparent. Implementing a data-driven culture is key to driving a personalised CX. The tight integration between CRM databases and the applications in the contact centre is becoming more important than ever.

Zoom is no stranger in today’s world of video and collaboration. Organisations would have heard of Zoom, trialled the product or are now users of the product for video collaboration. Zoom’s success is built on the simplicity of their technology and the ability of the solution to be deeply embedded within workflows. They have put some serious thoughts into user design and how that experience through the app or when launching the solution from the PC/ laptop allows for a smooth integration to email, calendars as well as other popular collaboration applications (including Slack). The market for cloud videoconferencing is growing rapidly. As the market shifts towards new and more agile ways of working and as co-working spaces rise globally, the need to collaborate and communicate instantaneously without too much hassle and interruptions will be critical. We are living in an era where it will be all about the experience.

Zoom’s share value has risen more than 120% from the $36 IPO debut price. Zoom has been focusing on building a base of high-value customers (those that spend more than USD 100,000 per year for services). In the last quarter alone the number of high-value customers went up by over 17%.

Rapid expansion outside of the ANZ region

Zoom has witnessed rapid growth in the ANZ region in recent years. Demand for the solution continues to come from both medium and large enterprises. Japan will be an important market for Zoom and they are starting to work with some big names in the market such as Rakuten and are expanding on growing their partner network. With a good data centre footprint which is critical for video and collaboration, other key markets for Zoom in Asia include India, South East Asia, Hong Kong and China. Their wins in these markets are from some of the biggest brands and conglomerates. Zoom’s growth in Asia is demonstrating how their cloud-based video solution is becoming the preferred platform, even if IT has already invested in other cloud video offerings. Demand is coming from the lines of business and not necessarily through IT. That is a big differentiator – Zoom being used by lines of business changes the entire sales process. It is now driven by word of mouth and individual user experience and LOBs which then becomes a companywide opportunity for Zoom. When you put that into context, the sheer numbers in terms of users within an organisation becomes large.

The launch of Zoom Phone

Zoom launched their Zoom Phone cloud phone service in Australia, supporting local phone numbers and PSTN access with new metered and unlimited call plans. Customers have the option of using their own carrier or using a Zoom number. The launch of Zoom phone should not be taken lightly by their competitors as they have so far succeeded in pulling customers to their app and impressing them with the user experience. Once the customer is locked into Zoom, the user experience has somehow led them to want to use it even more. With the launch of voice, they are now pushing themselves deeper into an account by creating upsell opportunities in workplace video, collaboration and voice technologies. This allows them to take on UC players across the stack of video, voice and collaboration.

Accelerating deep partnerships with leading cloud innovators

Zoom has strong partnerships with leading cloud platforms. Zoom’s partnership with Dropbox allows customers of both services to start a Zoom Meeting while viewing or working on shared files via shortcuts built into Dropbox’s viewer tool. The Atlassian partnership, for instance, allows Jira Ops to be integrated with Zoom. Users will be able to start a meeting directly from a Jira Ops ticket with anyone associated with the ticket. These are some of the partnerships and it demonstrates how Zoom has thought about other critical cloud apps that are important for day-to-day work and collaboration and the ability that can make Zoom the app that can provide that in-between integration for collaboration.

Ecosystm Comments

Zoom’s architecture is video-first, cloud-native and optimised to process and deliver high-quality video across devices. They reported recently that their approach to video has been uniquely different from that taken by others who have attempted to add a video to an aging, pre-existing conference call or chat tool. Zoom developed a proprietary multimedia router optimised for the cloud that separates content processing from the transporting and mixing of streams.

With the launch of Zoom Phone and the adoption they are witnessing of their video platform, Zoom is set to be a leading provider in video and voice collaboration. We can expect Zoom to further build on the office collaboration stack in the near future. As organisations start deploying solutions from cloud innovators such as AWS, Slack, Microsoft, Google and others, Zoom stands out from that standpoint. They are a cloud innovator that has thought about the issues of the past and the pain points of those using video. The thinking behind user design and simplicity and the integration to workflows has paved the way for the success they are seeing today.

As they grow their presence with some of the largest brands and Fortune 500 companies in the Asia Pacific region, they will also start attracting partners who will want to be part of that journey with them so it’s a win-win for both parties. These partnerships will include a range – from the existing players in the video to other workplace collaboration vendors.

For the fiscal year ended January 31, 2019, Zoom reported that 55% of their 344 high-end customers started with at least one free host prior to subscribing. These 344 customers also contributed to 30% of revenue in that fiscal year.

The journey has just started for Zoom in Asia Pacific and we can expect the next 12 months to be good for them as they expand rapidly across the region.

8×8 an enterprise communications player in the areas of voice, video, chat and contact centre solutions announced the acquisition Wavecell, a Singapore-based global Communications Platform-as-a-Service (CPaaS) provider last week. The deal is estimated to be for about USD 125 million in cash and stocks.

With this acquisition, 8×8 can leverage their CPaaS platform capabilities to enable companies to develop and embed communications features more easily. Enterprises can get direct access to pre-built features via Application Programming Interfaces (APIs) leveraging CPaaS. These APIs let developers pay for the services they need when building voice, video, chat, SMS, and web capabilities. By using a cloud CPaaS, developers can also eliminate lengthy development times and reduce time to market.

What does this acquisition mean for 8×8 in the Asia Pacific region?

- Establishes their presence in the rapidly growing CPaaS space. The CPaaS market is growing rapidly which includes key players like Twillio and Vonage. The Wavecell acquisition will allow 8×8 to offer a platform for providing SMS, messaging, voice, and video APIs globally to both enterprises and developers. Wavecell offers a complete CPaaS solution including a cloud API platform with SMS, chat apps, video interaction and voice APIs that enable mission-critical enterprise applications such as Application-to-Person (A2P) messaging, omnichannel customer journeys and multi-factor authentication at scale.

- Expands their footprint in the Asia Pacific region. With this acquisition, 8×8 will now have a good footprint in markets which includes Singapore, Indonesia, Philippines, Thailand, and Hong Kong. 8×8 is active mainly in the ANZ region. Wavecell has more than 500 enterprise including names such as Paidy, Tokopedia and Lalamove. Wavecell also brings an R&D centre in Asia which allows 8×8 to further accelerate growth in product innovation and delivery.

- Gives access to a large enterprise developer community. Wavecell have built a robust enterprise developer community over the past several years which has leveraged their API platform and software development kits. 8×8 can now enable application providers, enterprise developers, and customers to access and natively integrate their enterprise applications with 8×8’s voice, video and messaging services.

- Provides global coverage for multi-channel communications. Wavecell has established relationships with 192 network operators worldwide and business partners such as WhatsApp. Its carrier-grade infrastructure enables customers to share more than two billion messages per year across these channels. This global network enables Wavecell customers such as Lalamove, to use SMS to immediately notify customers of their ordering and delivery requests. The acquisition extends 8×8’s global carrier relationships and network support to hundreds of additional carriers, enabling 8×8 to further optimise their global service delivery for enterprise customers anywhere they operate around the world.

Ecosystm Comments

The CPaaS market is growing rapidly globally. Developers want to easily add real-time communication capabilities such as voice, video and chat apps through APIs with a faster time to market. The ability to do it easily and to be able to scale without a lengthy implementation cycle and at an affordable cost is becoming key. This acquisition will help 8×8 compete in the growing CPaaS market where players such as Twillio and Vonage are growing their presence rapidly.

The enterprise communications and contact centre segments are highly competitive spaces in Asia Pacific with several new entrants in the region in the last 18 months. These players, mainly from North America, offer strong capabilities in the areas of voice, video, collaboration and contact centres. 8×8 has been strong predominantly in the ANZ region. They have plans to open an office in Japan later this year. The Wavecell acquisition will help 8×8 expand and open doors for their core product offerings in South East Asia and Hong Kong. Wavecell’s large customer base of over 500 customers will give 8×8 an opportunity to upsell their enterprise and contact centre applications.

Some customers are still buying enterprise and contact centre technology from various vendors depending on who is the right vendor for voice, video, contact centre and other applications as opposed to working with one vendor for their end-to-end solution. 8×8’s advantage against some of their competitors is that they own the entire stack of their offerings. That has been important to some of their customers who have said that it has also benefited them from a security perspective. Most of their clients who have moved to their platform have done so due to scalablity, ease of implementation and fast deployment times.

This acquisition is definitely a step in the right direction for 8×8.

Critical Communications World, 2019 – TCCA’s largest event in global public safety communication – was held in Kuala Lumpur in June. Mission-critical communications are essential to maintaining safety and security across a range from daily operations to extreme events including disaster recovery. A UN report estimated that economic losses from natural disasters could reach USD 160 billion annually by 2030.

I attended the event as a guest of Motorola Solutions – one of the leaders in this field. Many people associate Motorola only with phones not knowing that they have been the cornerstone of some of the largest critical communications deployments around the globe. For instance, Victoria Police completed its AUD 50M+ rollout of Motorola Solutions managed services, enabling almost 10,000 police officers across Victoria access to mobile devices loaded with smart apps, and data when and where they need it most.

Motorola’s ability to provide customers with a private network which is secure, robust and redundant in the event of disaster has also been one of the reasons for their success in the industry. In the event of natural disasters or terrorist attacks, situations can arise where networks will not be available to send and transport any information. Having a secure and private network is critical. That explains why some of the largest police departments in Asia work with Motorola and these include Singapore, Malaysia and Indonesia.x

Motorola acquired Australian mobile application developer Gridstone in 2016 and Avigilon, an advanced video surveillance and analytics provider in 2018. These acquisitions demonstrate how Motorola is innovating in the areas of software, video analytics and AI.

Key Takeaways:

Public Safety Moving to a Collaborative Platform with AI and Machine Learning

Andrew Sinclair, Global Software Chief for Motorola Solutions sees AI enhancing future command and control centres and allowing greater analytics of emergency calls. Call histories and transcriptions, the incident management stack, community engagement data and post incidence reporting are all important elements for command and control centres. Using AI to sieve through the information will empower the operator with the right data and to make the right on-the-spot decisions.

The Avigilon acquisition, enhances Motorola’s AI capabilities and less time is spent monitoring videos, giving first responders more time to do their jobs. The AI technology can make “sense” of the information by using natural language technology. For example, if asked to find a child in a red t-shirt, the cameras can detect the child and also create a fingerprint of the child. The solution enables faster incidence detection by using an edge computing platform. It gathers the information and processes it to relevant agencies making the search operation faster and more streamlined. The application of AI in the video monitoring space is still in its early days and the potential ahead for this technology is enormous.

The other area that can empower first responders better are voice activated devices. The popularity of Alexa and Echo in the consumer world will see greater innovation in the application of public safety solutions. For example, police officers responding to an emergency may have very little time to look at screens or attend to other applications that need touching or pressing of a button as time and attention is essential is such scenarios. The application of voice activated devices will be critical for easing the job of the police officer on the ground. This will not only save administrative work on activities such as transcription, but also help in creating better accounts of the actual happenings for potential court proceedings.

While it is still early days for a full-fledged AR deployment in public safety, there are potential use cases. For example, firemen standing outside a building to make sense of the surrounding area could use AR to send information back to the command and control centres.

The Growth of Cloud-driven Collaboration

Seng Heng Chuah, VP for Motorola APJ talked about the importance of all agencies in public safety to be more open and collaborative. For instance, currently most ambulance, police and fire departments work in silos and have their own apps and legacy systems. To achieve the Smart City or Safe City concept, collaborating and sharing information on one common platform will be key. He talked about the “Home Team” concept that the Singapore Government has achieved. Allowing all agencies to collaborate and share information will mean the ability to make faster decisions during a catastrophe. Making “sense” of the IoT, voice and video data will be important areas of innovation. Normally when a disaster happens, operators at command and control centres – as well as onsite staff – face elevated stress levels and accurate information can help alleviate that.

The move towards the public cloud is also becoming more relevant for agencies. In the past there was resistance and it was always about having the data on their own premises. In recent years more public safety agencies are embracing the cloud. When you have vast amounts of data from video, IoT devices and other data sources, it becomes expensive for public safety agencies to store the data on premise. Seng Heng talked about how public safety agencies are starting to “trust’’ the cloud more now. According to him, Microsoft has done a good job in working with local governments around the world, and their government clouds have many layers of certifications as well as a strong data centre footprint in countries. The collaboration between agencies and more importantly agencies embracing the cloud will drive greater efficiency in analysing, transcribing and storing the data.

The Rise of Outcome-based, Services-led Opportunities

Steve Crutchfield, VP of Motorola Solutions for ANZ, talked about how Motorola is a services-led business in the ANZ market. 45% of Motorola’s business in ANZ is comprised of managed services. The ANZ region is unique as it is seen as early adopters and innovators around public safety implementations. Organisations approach Motorola for the outcomes. Police and Ambulance for example in the state of Victoria use their services on a consumption model. Customers across Mining, Transportation, and Emergency Services want an end-to-end solution across the network, voice, video and analytics.

The need for a private and secure network is significant in several industries. In the mines, safety is of priority and as soon as the radio goes down it impacts productivity and when production stops that can results in huge losses for the mines. Hence the need for a reliable private network that is secure for the transportation of voice and video communication is critical.

Crutchfield talked about how the partner ecosystem is evolving with Motorola working with partners such as Telstra and Orion but increasingly looking for specialised line of business partners and data aggregation partners. Motorola works with 55 channel partners in the region.

Ecosystm Comment:

Motorola Solutions is an established player in providing an end-to-end solution in the critical communications segment. The company is innovating in the areas of software and services coupled with the application of AI. Dr Mahesh Saptharishi, CTO at Motorola Solutions talked about how AI will eventually evolve into “muscle memory”. That will mean that there is far greater “automatic’’ intelligence in helping the first responders make critical decisions when faced with a tough situation.

In the end the efficacy of critical communications solutions will not just be the technology stack, but the desire and ability for cross-agency collaboration. As public safety agencies analyse large volumes of data sets from the network right to the applications, they will have to embrace the cloud, and which will help them achieve scale and security when storing information in the cloud. From the discussions, it was clear that the public safety agencies have started acknowledging the need to do so and we can expect that shift to happen soon.

Motorola will need to keep evolving their channel partner model and start partnering with new providers that can help in delivering some of the end-to-end capabilities across Mobility, AI, software, analytics and IoT. Many of their traditional partners may not be able to be that provider as the company evolves into driving end-to-end intelligent data services for their clients. The company is playing in a unique space with very few competitors that can offer the breadth and depth of critical communications solutions.

I was invited recently by NEC to attend their briefing where Walter Lee, their Evangelist and Government Relations Leader presented to analysts and journalists about how they are winning large contracts across various sectors in the areas of biometrics and surveillance. Biometrics is not just used as a way to drive greater security, but is also helping increase speed in processing times, reducing waiting period in queues and used as a way to drive efficiency and reduce costs which was highlighted by Lee through the various projects NEC had won recently.

NEC’s Artificial intelligence (AI) engine, NeoFace’s strength lies in its tolerance of poor-quality images. The NeoFace solution can match images with low resolutions down to 24 pixels between the eyes and this has allowed it to demonstrate the matching accuracy which is hard to achieve for most vendors offering Facial Recognition solutions. It is its ability to work across various challenges around low resolution, light and images that has allowed NEC to be one of the leading suppliers of Facial Recognition solutions globally.

Key Case Studies Presented

In 2018 Delta Airlines launched the first ‘biometric terminal’ in the US at the international terminal in Atlanta’s Hartsfield-Jackson airport. The biometric push according to Lee replaces tickets and customers now check in by using their face. The system recognises their face and they are checked in. Customers no longer need to use their passports to get through checkpoints around the airport. Lee emphasised on how it takes 9 minutes to board an international flight. Apart from driving identification and security, this use case highlights how airports around the world can increase efficiency in their overall check in and boarding processes at airports. Other core benefits derived from this implementation include better security for border control, seamless service, speed of boarding (savings of 9 minutes per flight). Privacy issues were addressed with regards to where the data was residing and how long the data would be kept for and in this case the data was kept for only 24 hours.

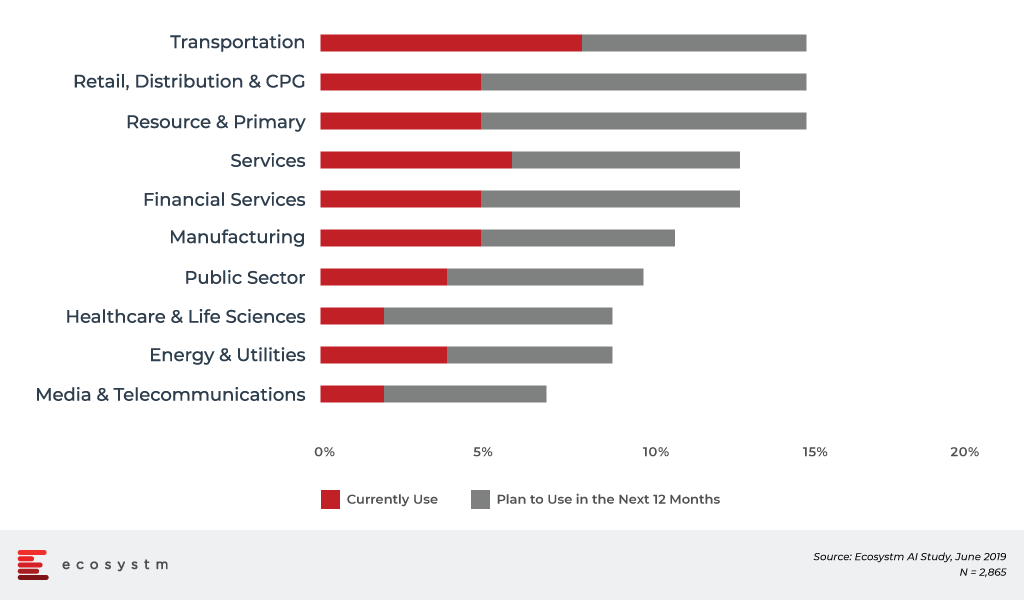

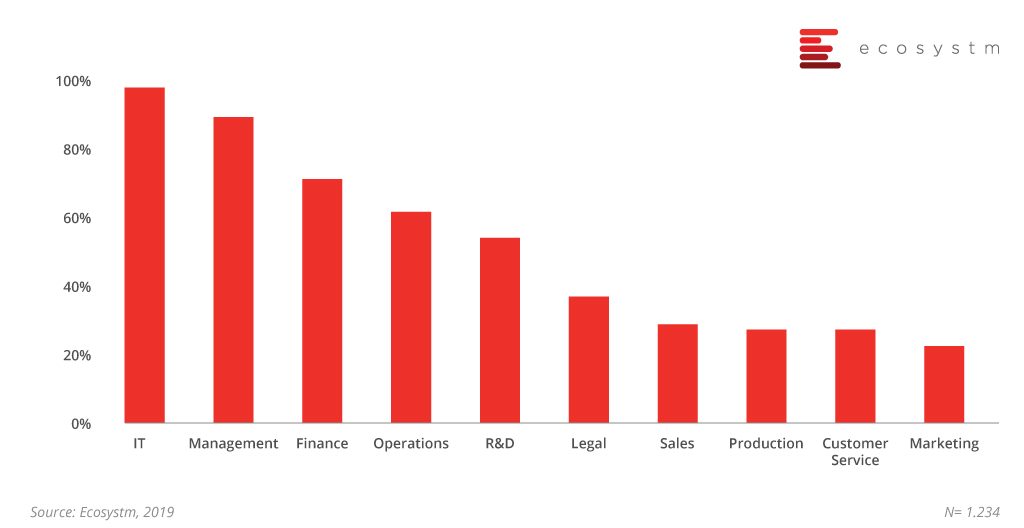

According to the global Ecosystm AI study of current and planned Facial Recognition adoption by industry, the transportation industry is leading the number of deployments globally.

Adoption of Facial Recognition by Industries

Another case study presented is the upcoming 2020 Summer Olympic and Paralympic Games in Tokyo., for which NEC will provide the Facial Recognition solution. The solution will be used to identify over 300,000 people at the games including athletes and officials. It is the first time that Facial Recognition technology will be used for this purpose at an Olympic Games. The NEC solution will allow the matching of tens of thousands of faces in a nano second according to Lee.

The Tokyo 2020 implementation will involve linking photo data with an IC card to be carried by accredited people. NEC says that it has the world’s leading face recognition tech based on benchmark tests from the US’s National Institute of Standards and Technology (NIST).

Ecosystm Comment.

NEC has years of experience in biometrics and Facial Recognition. Not many vendors have solutions that can capture vast amounts of images in a nano second. Their solutions are used by some of the largest organisations in the world. NEC has also perfected the art of handling low resolution images which if not analysed accurately can lead to unintended consequences. The ability to process low resolution images with speed and accuracy is not something that is easily achievable. Security and the rise of terrorism are some of the needs as to why Facial Recognition is important. Additionally, speed and efficiency in administrating passenger boarding at airports whilst ensuring that the security and identity checks have been made is important. The Delta Airlines case study is a great example of how there can be a savings of 9 minutes per flight. NEC continues to gain traction in the market and the Ecosystm AI study has them as one of the top vendors being evaluated for planned implementations for Facial Recognition globally.

The benefits of Facial Recognition solutions are huge – however there must be greater scrutiny around the possible outcomes of AI. Whilst regulation on AI is still at its infancy, 2019 and 2020 will see greater scrutiny and regulation around AI implementations. These will be directed towards protecting individual’s data but also there will be greater emphasis on addressing issues around privacy, ethics and bias in AI implementations. Feeding the machine with the right data (unbiased and ethical) and measuring the various outcomes before the project goes live must be looked at with greater diligence.

2 weeks ago, San Francisco became the first US city to ban the use of Facial Recognition technology by the police and local government agencies. One of the reasons for the ban was with regard to bias. When designing the systems, if technology specialists feed the wrong information for example recognising only a certain skin colour, then the problem of making the wrong and unwanted assumptions start arising. The ecosystem of players in the AI industry ranging from government, academia right down to vendors have a greater role to play in ensuring ethics and bias issues are addressed from the onset of the project. There are consultants in the market as I highlighted in my recent Ecosystm report, that prepare companies for the impact of ethics, fairness and bias. We can expect more of such consultancies and specialist agencies to grow in the market.

NEC has taken this into consideration and published a set of principles for the application of biometrics and AI. The “NEC Group AI and Human Rights Principles” will guide the company along the lines of privacy and human rights. These initiatives were led by the Digital Trust Business Strategy Division, in collaboration with several other divisions within the company, as well as industry stakeholders including industry experts and non-profit organisations.

I recently attended the Verint Engage event in Sydney, which had over 700 attendees. Conversations on artificial intelligence (AI) and analytics garnered a lot of attention this year. Verint showcased the deployments of intelligent conversational bots used by some of the biggest brands in Asia Pacific. Some of these customers include Spark NZ, Suncorp and AAMI. In 2018, the company acquired Next IT, a provider of conversational AI virtual assistant, to accelerate their move in the automation and analytics space. Verint’s choice of Next IT was driven by the need to provide their customers with a solution that has deep expertise in the contact centre space and to have an automation solution that is deeply integrated into their broad portfolio of solutions.

Last week, Verint announced the launch of AI Blueprint, a conversation analysis system that identifies intelligent virtual assistant (IVA) use cases and accelerates automation. The solution then delivers a “blueprint” of precisely how businesses can get started with AI or continue to grow their AI capabilities.

Verint is no stranger to the contact centre market and has an established presence in areas of quality monitoring, analytics, knowledge management and compliance.

Key Takeaways from Customers on Intelligent Virtual Assistants:

- Engaging senior stakeholders. For a successful deployment, many organisations had to involve senior management in the discussion. These ranged from CIOs, CDOs and CEOs. The conversation around automation and AI for customer service is no longer contained within the contact centre. Many organisations spoke about having senior management involved in the pre and post launch of the virtual assistant deployment. Getting buy-in and feedback from senior management is key as the AI discussion forms part of a broader digital strategy for the organisation. The global Ecosystm AI study, which is live and ongoing, also finds that senior management is the second highest influencer for AI procurement and implementations.

- Integrating Knowledge Management to the AI deployment is important. Organisations at the Verint Engage event highlighted that the route to a successful intelligent virtual assistant deployment is to embed knowledge management capabilities into the AI platform. By failing to incorporate knowledge management, the intelligent virtual assistant experience will be poor, leaving customers frustrated.

- Working with a vendor that understands contact centres is key. Some of the customers at the event had worked with other well-known brands AI in the market prior to working with Verint. They moved to Verint primarily for two reasons. One was that the cost of deployment was less on the Verint platform and secondly, they wanted to work with a vendor that not only understood AI but that had a deep understanding of the contact centre environment. Compliance, training, speech analytics, coaching and quality monitoring are core capabilities of Verint’s portfolio. These are important elements in the overall deployment of AI.

- Striking the right balance between automation and voice. Several of the organisations highlighted the savings realised, when the deployment was done well and fully integrated into knowledge management. Automation will in the long run help reduce contact centre calls and live chat costs. However, it was emphasised that the agent or human element remains important and cannot be ignored. The seamless hand off to the agent when the query cannot be answered is important.

Ecosystm Comment:

Virtual assistants need to be fed with the right information to make the discussion with the customer engaging. A solid knowledge management strategy is key to the success of a virtual assistant deployment. Without analytics and knowledge management integrated into AI, the CX will be poor leaving customers feeling frustrated. When deployed well, the virtual assistant can help answer most of the queries due to a structured knowledge bank with detailed FAQ. The ability to have it updated regularly and in real time is critical. It is important for contact centres to not rely on full automation within the contact centre.

Verint is starting to win deals in the AI and virtual assistant space with some of the largest brands in Asia Pacific. Some of the customers include those from the financial services sector. Verint’s success is not just in the intelligent virtual assistant market. It is their ability to deliver an all-encompassing solution across self-service, analytics, knowledge management, quality monitoring and compliance.