The increasing alignment between IT and business functions, while crucial for organisational success, complicates the management of enterprise systems. Tech leaders must balance rapidly evolving business needs with maintaining system stability and efficiency. This dynamic adds pressure to deliver agility while ensuring long-term ERP health, making management increasingly complex.

As tech providers such as SAP enhance their capabilities and products, they will impact business processes, technology skills, and the tech landscape.

At SAP NOW Southeast Asia in Singapore, SAP presented their future roadmap, with a focus on empowering their customers to transform with agility. Ecosystm Advisors Sash Mukherjee and Tim Sheedy provide insights on SAP’s recent announcements and messaging.

Click here to download SAP NOW Southeast Asia: Highlights

What was your key takeaway from the event?

TIM SHEEDY. SAP is making a strong comeback in Asia Pacific, ramping up their RISE with SAP program after years of incremental progress. The focus is on transitioning customers from complex, highly customised legacy systems to cloud ERP, aligning with the region’s appetite for simplifying core processes, reducing customisations, and leveraging cloud benefits. Many on-prem SAP users have fallen behind on updates due to over-customisation, turning even minor upgrades into major projects – and SAP’s offerings aim to solve for these challenges.

SASH MUKHERJEE. A standout feature of the session was the compelling customer case studies. Unlike many industry events where customer stories can be generic, the stories shared were examples of SAP’s impact. From Mitr Phol’s use of SAP RISE to enhance farm-to-table transparency to CP Group’s ambitious sustainability goals aligned with the SBTi, and Standard Chartered Bank’s focus on empowering data analytics teams, these testimonials offered concrete illustrations of SAP’s value proposition.

How is SAP integrating AI into their offerings?

TIM SHEEDY. SAP, like other tech platforms, is ramping up their AI capabilities – but with a twist.

They are not only highlighting GenAI but also emphasising their predictive AI features. SAP’s approach focuses on embedded AI, integrating it directly into systems and processes to offer low-risk, user-friendly solutions.

Joule, their AI copilot, is enterprise-ready, providing seamless integration with SAP backend systems and meeting strict compliance standards like GDPR and SOC-II. By also integrating with Microsoft 365, Joule extends its reach to daily tools like Outlook, Teams, Word, and Excel.

While SAP AI may lack the flash of other platforms, it is designed for SAP users – managers and board members – who prioritise consistency, reliability, and auditability alongside business value.

What is the value proposition of SAP’s Clean Core?

SASH MUKHERJEE. SAP’s Clean Core marks a strategic shift in ERP management.

Traditionally, businesses heavily customised SAP to meet specific needs, resulting in complex and costly IT landscapes. Clean Core advocates for a standardised system with minimal customisations, offering benefits like increased agility, lower costs, and reduced risk during upgrades. However, necessary customisations can still be achieved using SAP’s BTP.

The move to the Clean Core is often driven by CEO mandates, as legacy SAP solutions have become too complex to fully leverage data. For example, an Australian mining company reduced customisations from 27,000 to 200, and Standard Chartered Bank used Clean Core data to launch a carbon program within four months.

However, the transition can be challenging and will require enhanced developer productivity, expansion of tooling, and clear migration paths.

How is SAP shifting their partner strategy?

As SAP customers face significant transformations, tech partners – cloud hyperscalers, systems integrators, consulting firms and managed services providers – will play a crucial role in executing these changes before SAP ECC loses support in 2027.

TIM SHEEDY. SAP has always relied on partners for implementations, but with fewer large-scale upgrade projects in recent years, many partner teams have shrunk. Recognising this, SAP is working to upskill partners on RISE with SAP. This effort aims to ensure they can effectively manage and optimise the modern Cloud ERP platform, utilise assets, templates, accelerators, and tools for rapid migration, and foster continuous innovation post-migration. The availability of these skills in the market will be essential for SAP customers to ensure successful transitions to the Cloud ERP platform.

SASH MUKHERJEE. SAP’s partner strategy emphasises business transformation over technology migration. This shift requires partners to focus on delivering measurable business outcomes rather than solely selling technology. Given the prevalence of partner-led sales in Southeast Asia, there is a need to empower partners with tools and resources to effectively communicate the value proposition to business decision-makers. While RISE certifications will be beneficial for larger partners, a significant portion of the market comprises SMEs that rely on smaller, local partners – and they will need support mechanisms too.

What strategies should SAP prioritise to maintain market leadership?

TIM SHEEDY. Any major platform change gives customers an opportunity to explore alternatives.

Established players like Oracle, Microsoft, and Salesforce are aggressively pursuing the ERP market. Meanwhile, industry-specific solutions, third-party support providers, and even emerging technologies like those offered by ServiceNow are challenging the traditional ERP landscape.

However, SAP has made significant strides in easing the transition from legacy platforms and is expected to continue innovating around RISE with SAP. By offering incentives and simplifying migration, SAP aims to retain their customer base. While SAP’s focus on renewal and migration could pose challenges for growth, the company’s commitment to execution suggests they will retain most of their customers. GROW with SAP is likely to be a key driver of new business, particularly in mid-sized organisations, especially if SAP can tailor offerings for the cost-sensitive markets in the region.

Ecosystm presents “The AI Readiness Barometer: ASEAN’s AI Landscape” report – a comprehensive analysis of AI adoption trends in the region, focusing on high-impact use cases for various business units.

Conducted by Ecosystm in partnership with IBM, the whitepaper is based on a study that evaluated organisations based on four key criteria: culture and leadership, skills and people, data foundation, and governance framework. These scores were then aggregated to categorise organisations into five stages of AI readiness: traditional, emerging, consolidating, transformative, or AI-first.

Download Whitepaper – The AI Readiness Barometer: ASEAN’s AI Landscape

(Clicking on this link will take you to the IBM website where you can download the whitepaper)

The global data protection landscape is growing increasingly complex. With the proliferation of privacy laws across jurisdictions, organisations face a daunting challenge in ensuring compliance.

From the foundational GDPR, the evolving US state-level regulations, to new regulations in emerging markets, businesses with cross-border presence must navigate a maze of requirements to protect consumer data. This complexity, coupled with the rapid pace of regulatory change, requires proactive and strategic approaches to data management and protection.

GDPR: The Catalyst for Global Data Privacy

At the forefront of this global push for data privacy stands the General Data Protection Regulation (GDPR) – a landmark legislation that has reshaped data governance both within the EU and beyond. It has become a de facto standard for data management, influencing the creation of similar laws in countries like India, China, and regions such as Southeast Asia and the US.

However, the GDPR is evolving to tackle new challenges and incorporate lessons from past data breaches. Amendments aim to enhance enforcement, especially in cross-border cases, expedite complaint handling, and strengthen breach penalties. Amendments to the GDPR in 2024 focus on improving enforcement efficiency. The One-Stop-Shop mechanism will be strengthened for better handling of cross-border data processing, with clearer guidelines for lead supervisory authority and faster information sharing. Deadlines for cross-border decisions will be shortened, and Data Protection Authorities (DPAs) must cooperate more closely. Rules for data transfers to third countries will be clarified, and DPAs will have stronger enforcement powers, including higher fines for non-compliance.

For organisations, these changes mean increased scrutiny and potential penalties due to faster investigations. Improved DPA cooperation can lead to more consistent enforcement across the EU, making it crucial to stay updated and adjust data protection practices. While aiming for more efficient GDPR enforcement, these changes may also increase compliance costs.

GDPR’s Global Impact: Shaping Data Privacy Laws Worldwide

Despite being drafted by the EU, the GDPR has global implications, influencing data privacy laws worldwide, including in Canada and the US.

Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA) governs how the private sector handles personal data, emphasising data minimisation and imposing fines of up to USD 75,000 for non-compliance.

The US data protection landscape is a patchwork of state laws influenced by the GDPR and PIPEDA. The California Privacy Rights Act (CPRA) and other state laws like Virginia’s CDPA and Colorado’s CPA reflect GDPR principles, requiring transparency and limiting data use. Proposed federal legislation, such as the American Data Privacy and Protection Act (ADPPA), aims to establish a national standard similar to PIPEDA.

The GDPR’s impact extends beyond EU borders, significantly influencing data protection laws in non-EU European countries. Countries like Switzerland, Norway, and Iceland have closely aligned their regulations with GDPR to maintain data flows with the EU. Switzerland, for instance, revised its Federal Data Protection Act to ensure compatibility with GDPR standards. The UK, post-Brexit, retained a modified version of GDPR in its domestic law through the UK GDPR and Data Protection Act 2018. Even countries like Serbia and North Macedonia, aspiring for EU membership, have modeled their data protection laws on GDPR principles.

Data Privacy: A Local Flavour in Emerging Markets

Emerging markets are recognising the critical need for robust data protection frameworks. These countries are not just following in the footsteps of established regulations but are creating laws that address their unique economic and cultural contexts while aligning with global standards.

Brazil has over 140 million internet users – the 4th largest in the world. Any data collection or processing within the country is protected by the Lei Geral de Proteção de Dados (or LGPD), even from data processors located outside of Brazil. The LGPD also mandates organisations to appoint a Data Protection Officer (DPO) and establishes the National Data Protection Authority (ANPD) to oversee compliance and enforcement.

Saudi Arabia’s Personal Data Protection Law (PDPL) requires explicit consent for data collection and use, aligning with global norms. However, it is tailored to support Saudi Arabia’s digital transformation goals. The PDPL is overseen by the Saudi Data and Artificial Intelligence Authority (SDAIA), linking data protection with the country’s broader AI and digital innovation initiatives.

Closer Home: Changes in Asia Pacific Regulations

The Asia Pacific region is experiencing a surge in data privacy regulations as countries strive to protect consumer rights and align with global standards.

Japan. Japan’s Act on the Protection of Personal Information (APPI) is set for a major overhaul in 2025. Certified organisations will have more time to report data breaches, while personal data might be used for AI training without consent. Enhanced data rights are also being considered, giving individuals greater control over biometric and children’s data. The government is still contemplating the introduction of administrative fines and collective action rights, though businesses have expressed concerns about potential negative impacts.

South Korea. South Korea has strengthened its data protection laws with significant amendments to the Personal Information Protection Act (PIPA), aiming to provide stronger safeguards for individual personal data. Key changes include stricter consent requirements, mandatory breach notifications within 72 hours, expanded data subject rights, refined data processing guidelines, and robust safeguards for emerging technologies like AI and IoT. There are also increased penalties for non-compliance.

China. China’s Personal Information Protection Law (PIPL) imposes stringent data privacy controls, emphasising user consent, data minimisation, and restricted cross-border data transfers. Severe penalties underscore the nation’s determination to safeguard personal information.

Southeast Asia. Southeast Asian countries are actively enhancing their data privacy landscapes. Singapore’s PDPA mandates breach notifications and increased fines. Malaysia is overhauling its data protection law, while Thailand’s PDPA has also recently come into effect.

Spotlight: India’s DPDP Act

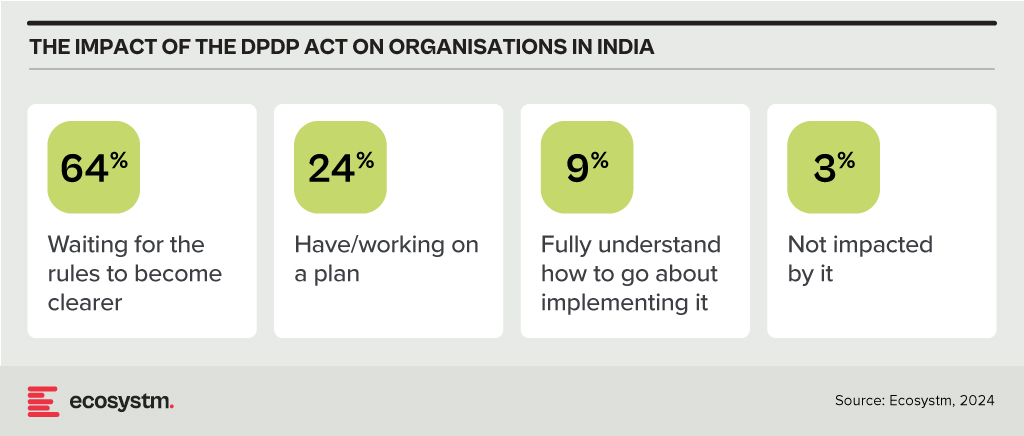

The Digital Personal Data Protection Act, 2023 (DPDP Act), officially notified about a year ago, is anticipated to come into effect soon. This principles-based legislation shares similarities with the GDPR and applies to personal data that identifies individuals, whether collected digitally or digitised later. It excludes data used for personal or domestic purposes, aggregated research data, and publicly available information. The Act adopts GDPR-like territorial rules but does not extend to entities outside India that monitor behaviour within the country.

Consent under the DPDP Act must be free, informed, and specific, with companies required to provide a clear and itemised notice. Unlike the GDPR, the Act permits processing without consent for certain legitimate uses, such as legal obligations or emergencies. It also categorises data fiduciaries based on the volume and sensitivity of the data they handle, imposing additional obligations on significant data fiduciaries while offering exemptions for smaller entities. The Act simplifies cross-border data transfers compared to the GDPR, allowing transfers to all countries unless restricted by the Indian Government. It also provides broad exemptions to the State for data processing under specific conditions. Penalties for breaches are turnover agnostic, with considerations for breach severity and mitigating actions. The full impact of the DPDP Act will be clearer once the rules are finalised and the Board becomes operational, but 97% of Indian organisations acknowledge that it will affect them.

Conclusion

Data breaches pose significant risks to organisations, requiring a strong data protection strategy that combines technology and best practices. Key technological safeguards include encryption, identity access management (IAM), firewalls, data loss prevention (DLP) tools, tokenisation, and endpoint protection platforms (EPP). Along with technology, organisations should adopt best practices such as inventorying and classifying data, minimising data collection, maintaining transparency with customers, providing choices, and developing comprehensive privacy policies. Training employees and designing privacy-focused processes are also essential. By integrating robust technology with informed human practices, organisations can enhance their overall data protection strategy.

Organisational networks are struggling to keep pace with the spreading demands of a hybrid workforce. As we step further into a digitally driven world with an increasing worker diaspora and a hybrid workforce, the

challenges and opportunities in cybersecurity and networking are evolving at an unprecedented pace. Threats to organisations are multi-pronged and the possible points of attack have spread far beyond the enterprise

Ecosystm supported by their partners NEC Australia and Cisco conducted a Leaders Roundtable in Sydney, which was joined by technology and cyber experts. The discussion focused on best practices in using AI and tech innovations to ensure organisational network strategies meet the needs of a hybrid workforce.

Key insights from the discussions include:

💡 While business leaders are excited about AI, security teams emphasise the need for data readiness, guardrails, and clear policies before full integration.

💡AI-driven network security must prove ROI with high-value use cases and prototypes to gain leadership support.

💡Managing hybrid multi-cloud data is challenging; centralising data ensures security but may clash with the need for data federation.

💡GenAI and deep fakes introduce risks like executive impersonation and employee manipulation, requiring new technology and shifts in authentication practices.

💡Trust is essential for monitoring hybrid workers. Gamification and positive reinforcement are useful, but continuous education and practical solutions like anti-phishing gamification are key for ongoing security awareness.

To find out more, download the proceedings report from the session.

From Risk to Advantage: Building a Network Strategy for the Hybrid Workforce

(Clicking on this link will take you to the NEC website where you can download the Roundtable Summary Report)

Exiting the North-South Highway 101 onto Mountain View, California, reveals how mundane innovation can appear in person. This Silicon Valley town, home to some of the most prominent tech giants, reveals little more than a few sprawling corporate campuses of glass and steel. As the industry evolves, its architecture naturally grows less inspiring. The most imposing structures, our modern-day coliseums, are massive energy-rich data centres, recursively training LLMs among other technologies. Yet, just as the unassuming exterior of the Googleplex conceals a maze of shiny new software, GenAI harbours immense untapped potential. And people are slowly realising that.

It has been over a year that GenAI burst onto the scene, hastening AI implementations and making AI benefits more identifiable. Today, we see successful use cases and collaborations all the time.

Finding Where Expectations Meet Reality

While the data centres of Mountain View thrum with the promise of a new era, it is crucial to have a quick reality check.

Just as the promise around dot-com startups reached a fever pitch before crashing, so too might the excitement surrounding AI be entering a period of adjustment. Every organisation appears to be looking to materialise the hype.

All eyes (including those of 15 million tourists) will be on Paris as they host the 2024 Olympics Games. The International Olympic Committee (IOC) recently introduced an AI-powered monitoring system to protect athletes from online abuse. This system demonstrates AI’s practical application, monitoring social media in real time, flagging abusive content, and ensuring athlete’s mental well-being. Online abuse is a critical issue in the 21st century. The IOC chose the right time, cause, and setting. All that is left is implementation. That’s where reality is met.

While the Googleplex doesn’t emanate the same futuristic aura as whatever is brewing within its walls, Google’s AI prowess is set to take centre stage as they partner with NBCUniversal as the official search AI partner of Team USA. By harnessing the power of their GenAI chatbot Gemini, NBCUniversal will create engaging and informative content that seamlessly integrates with their broadcasts. This will enhance viewership, making the Games more accessible and enjoyable for fans across various platforms and demographics. The move is part of NBCUniversal’s effort to modernise its coverage and attract a wider audience, including those who don’t watch live television and younger viewers who prefer online content.

From Silicon Valley to Main Street

While tech giants invest heavily in GenAI-driven product strategies, retailers and distributors must adapt to this new sales landscape.

Perhaps the promise of GenAI lies in the simple storefronts where it meets the everyday consumer. Just a short drive down the road from the Googleplex, one of many 37,000-square-foot Best Buys is preparing for a launch that could redefine how AI is sold.

In the most digitally vogue style possible, the chain retailer is rolling out Microsoft’s flagship AI-enabled PCs by training over 30,000 employees to sell and repair them and equipping over 1,000 store employees with AI skillsets. Best Buy are positioning themselves to revitalise sales, which have been declining for the past ten quarters. The company anticipates that the augmentation of AI skills across a workforce will drive future growth.

The Next Generation of User-Software Interaction

We are slowly evolving from seeking solutions to seamless integration, marking a new era of User-Centric AI.

The dynamic between humans and software has mostly been transactional: a question for an answer, or a command for execution. GenAI however, is poised to reshape this. Apple, renowned for their intuitive, user-centric ecosystem, is forging a deeper and more personalised relationship between humans and their digital tools.

Apple recently announced a collaboration with OpenAI at its WWDC, integrating ChatGPT into Siri (their digital assistant) in its new iOS 18 and macOS Sequoia rollout. According to Tim Cook, CEO, they aim to “combine generative AI with a user’s personal context to deliver truly helpful intelligence”.

Apple aims to prioritise user personalisation and control. Operating directly on the user’s device, it ensures their data remains secure while assimilating AI into their daily lives. For example, Siri now leverages “on-screen awareness” to understand both voice commands and the context of the user’s screen, enhancing its ability to assist with any task. This marks a new era of personalised GenAI, where technology understands and caters to individual needs.

We are beginning to embrace a future where LLMs assume customer-facing roles. The reality is, however, that we still live in a world where complex issues are escalated to humans.

The digital enterprise landscape is evolving. Examples such as the Salesforce Einstein Service Agent, its first fully autonomous AI agent, aim to revolutionise chatbot experiences. Built on the Einstein 1 Platform, it uses LLMs to understand context and generate conversational responses grounded in trusted business data. It offers 24/7 service, can be deployed quickly with pre-built templates, and handles simple tasks autonomously.

The technology does show promise, but it is important to acknowledge that GenAI is not yet fully equipped to handle the nuanced and complex scenarios that full customer-facing roles need. As technology progresses in the background, companies are beginning to adopt a hybrid approach, combining AI capabilities with human expertise.

AI for All: Democratising Innovation

The transformations happening inside the Googleplex, and its neighbouring giants, is undeniable. The collaborative efforts of Google, SAP, Microsoft, Apple, and Salesforce, amongst many other companies leverage GenAI in unique ways and paint a picture of a rapidly evolving tech ecosystem. It’s a landscape where AI is no longer confined to research labs or data centres, but is permeating our everyday lives, from Olympic broadcasts to customer service interactions, and even our personal devices.

The accessibility of AI is increasing, thanks to efforts like Best Buy’s employee training and Apple’s on-device AI models. Microsoft’s Copilot and Power Apps empower individuals without technical expertise to harness AI’s capabilities. Tools like Canva and Uizard empower anybody with UI/UX skills. Platforms like Coursera offer certifications in AI. It’s never been easier to self-teach and apply such important skills. While the technology continues to mature, it’s clear that the future of AI isn’t just about what the machines can do for us—it’s about what we can do with them. The on-ramp to technological discovery is no longer North-South Highway 101 or the Googleplex that lays within, but rather a network of tools and resources that’s rapidly expanding, inviting everyone to participate in the next wave of technological transformation.

As AI evolves, the supporting infrastructure has become a crucial consideration for organisations and technology companies alike. AI demands massive processing power and efficient data handling, making high-performance computing clusters and advanced data management systems essential. Scalability, efficiency, security, and reliability are key to ensuring AI systems handle increasing demands and sensitive data responsibly.

Data centres must evolve to meet the increasing demands of AI and growing data requirements.

Equinix recently hosted technology analysts at their offices and data centre facilities in Singapore and Sydney to showcase how they are evolving to maintain their leadership in the colocation and interconnection space.

Equinix is expanding in Latin America, Africa, the Middle East, and Asia Pacific. In Asia Pacific, they recently opened data centres in Kuala Lumpur and Johor Bahru, with capacity additions in Mumbai, Sydney, Melbourne, Tokyo, and Seoul. Plans for the next 12 months include expanding in existing cities and entering new ones, such as Chennai and Jakarta.

Ecosystm analysts comment on Equinix’s growth potential and opportunities in Asia Pacific.

Small Details, Big Impact

TIM SHEEDY. The tour of the new Equinix data centre in Sydney revealed the complexity of modern facilities. For instance, the liquid cooling system, essential for new Nvidia chipsets, includes backup cold water tanks for redundancy. Every system and process is designed with built-in redundancy.

As power needs grow, so do operational and capital costs. The diesel generators at the data centre, comparable to a small power plant, are supported by multiple fuel suppliers from several regions in Sydney to ensure reliability during disasters.

Security is critical, with some areas surrounded by concrete walls extending from the ceiling to the floor, even restricting access to Equinix staff.

By focusing on these details, Equinix enables customers to quickly set up and manage their environments through a self-service portal, delivering a cloud-like experience for on-premises solutions.

Equinix’s Commitment to the Environment

ACHIM GRANZEN. Compute-intensive AI applications challenge data centres’ “100% green energy” pledges, prompting providers to seek additional green measures. Equinix addresses this through sustainable design and green energy investments, including liquid cooling and improved traditional cooling. In Singapore, one of Equinix’s top 3 hubs, the company partnered with the government and Sembcorp to procure solar power from panels on public buildings. This improves Equinix’s power mix and supports Singapore’s renewable energy sector.

TIM SHEEDY Building and operating data centres sustainably is challenging. While the basics – real estate, cooling, and communications – remain, adding proximity to clients, affordability, and 100% renewable energy complicates matters. In Australia, reliant on a mixed-energy grid, Equinix has secured 151 MW of renewable energy from Victoria’s Golden Plains Wind Farm, aiming for 100% renewable by 2029.

Equinix leads with AIA-rated data centres that operate in warmer conditions, reducing cooling needs and boosting energy efficiency. Focusing on efficient buildings, sustainable water management, and a circular economy, Equinix aims for climate neutrality by 2030, demonstrating strong environmental responsibility.

Equinix’s Private AI Value Proposition

ACHIM GRANZEN. Most AI efforts, especially GenAI, have occurred in the public cloud, but there’s rising demand for Private AI due to concerns about data availability, privacy, governance, cost, and location. Technology providers in a position to offer alternative AI stacks (usually built on top of a GPU-as-a-service model) to the hyperscalers find themselves in high interest. Equinix, in partnership with providers such as Nvidia, offers Private AI solutions on a global turnkey AI infrastructure. These solutions are ideal for industries with large-scale operations and connectivity challenges, such as Manufacturing, or those slow to adopt public cloud.

SASH MUKHERJEE. Equinix’s Private AI value proposition will appeal to many organisations, especially as discussions on AI cost efficiency and ROI evolve. AI unites IT and business teams, and Equinix understands the need for conversations at multiple levels. Infrastructure leaders focus on data strategy capacity planning; CISOs on networking and security; business lines on application performance, and the C-suite on revenue, risk, and cost considerations. Each has a stake in the AI strategy. For success, Equinix must reshape its go-to-market message to be industry-specific (that’s how AI conversations are shaping) and reskill its salesforce for broader conversations beyond infrastructure.

Equinix’s Growth Potential

ACHIM GRANZEN. In Southeast Asia, Malaysia and Indonesia provide growth opportunities for Equinix. Indonesia holds massive potential as a digital-savvy G20 country. In Malaysia, the company’s data centres can play a vital part in the ongoing Mydigital initiative, having a presence in the country before the hyperscalers. Also, the proximity of the Johor Bahru data centre to Singapore opens additional business opportunities.

TIM SHEEDY. Equinix is evolving beyond being just a data centre real estate provider. By developing their own platforms and services, along with partner-provided solutions, they enable customers to optimise application placement, manage smaller points of presence, enhance cloud interconnectivity, move data closer to hyperscalers for backup and performance, and provide multi-cloud networking. Composable services – such as cloud routers, load balancers, internet access, bare metal, virtual machines, and virtual routing and forwarding – allow seamless integration with partner solutions.

Equinix’s focus over the last 12 months on automating and simplifying the data centre management and interconnection services is certainly paying dividends, and revenue is expected to grow above tech market growth rates.

This white paper examines the challenges Australian SMEs face due to rising digital adoption. As businesses become more reliant on technology, managing complex IT infrastructure becomes difficult. The paper highlights the importance of IT observability, which helps proactively identify and resolve issues, for building a resilient and customer-centric business.

The study is based on a survey of 101 technology leaders from Australian mid-sized organisations. It reveals that 44% of the participants have already adopted monitoring practices, while the remaining are considering it.

Explore how implementing an IT observability framework can empower your SME to overcome technological challenges and enhance operational efficiency. Contact us today to learn more about transforming your IT strategy.

Download Whitepaper – Enhance Digital Resilience Through Observability

(Clicking on this link will take you to the ManageEngine site24x7 website where you can download the eBook)

Despite an increase in energy efficiency investment, the construction sector’s energy consumption and CO₂ emissions have rebounded to an all-time high. Buildings currently contribute 39% of global energy-related carbon emissions – 28% from operational needs like heating and cooling, and 11% from construction materials.

In the next three decades, with the global population expected to reach 9.7 billion, the construction industry will face the pressure to meet growing infrastructure and housing demands while adapting to stricter environmental regulations.

The urgency of climate action demands that governments mandate low-carbon practices in urban development.

Increase Use of Low-Carbon Materials

Traditional building materials like concrete, steel, and brick are strong and durable but environmentally costly. This high embodied carbon footprint is prompting a shift towards low-carbon alternatives. Indonesia is using ‘green cement’ – made using environmentally friendly materials – in the development of its new futuristic capital Nusantara. This has led to an estimated reduction in carbon emissions of up to 38% per tonne of cement so far.

Nordic countries are setting ambitious targets for low-carbon materials. Starting in 2025, Finland will require life cycle assessments and material declarations in construction to reduce emissions, detailing building components and material origins. Denmark is also prioritising low-carbon materials through energy-efficient designs, sustainable materials, and stringent building codes.

Mandate Whole-Life Carbon Emission Assessments

Whole Life-Cycle Carbon (WLC) emissions encompass all the carbon a building generates throughout its lifespan, from material extraction to demolition and disposal. Assessing WLC gives a comprehensive understanding of a building’s total environmental impact.

The London Plan is a roadmap for future development and achieving the goal of a zero-carbon city. The plan includes provisions for WLC analysis, specific energy hierarchies, and strategies to reduce London’s carbon footprint.

With a bold vision of a fully circular city by 2050, the Amsterdam Circular Strategy 2020-2025 lays out a comprehensive roadmap to achieve this goal. Key elements include mapping material flows to reduce reliance on virgin resources and mandating WLC assessments.

Enforce Clean Construction Standards

From green building codes to tax incentives, governments around the world are implementing innovative strategies to encourage sustainable building practices.

The Philippines’ National Building Code requires green building standards and energy efficiency measures for new buildings.

Seattle offers expedited permits for projects meeting embodied carbon standards, speeding up eco-friendly construction, and reinforcing the city’s environmental goals.

New Jersey offers businesses a tax credit of up to 5% for using low-carbon concrete and an additional 3% for concrete made with carbon capture technology.

Promote Large-Scale Adaptive Reuse

Large-scale adaptive reuse includes reducing carbon emissions by making existing buildings and infrastructure a larger part of the climate solution.

London’s Battersea Power Station restored its iconic chimneys and Art Deco façade, transforming it into a vibrant hub with residential, commercial, and leisure spaces.

The High Line in New York has been transformed into a public park with innovative landscaping, smart irrigation, and interactive art installations, enhancing visitor experience and sustainability.

Singapore using adaptive reuse to rejuvenate urban and industrial spaces sustainably. The Jurong Town Corporation is repurposing a terrace factory for sustainable redevelopment and preserving industrial heritage. In Queenstown, historical buildings in Tanglin Halt are being reused to maintain historical significance and add senior-friendly amenities.

Establish Circular Economy

As cities worldwide start exploring ways to go circular, some are already looking into different ways to leverage innovative practices to implement circular initiatives.

Toronto is embedding circular criteria into procurement by requiring circular economy profiles, vendor action plans, and encouraging circular design for parklets. The city also recommends actions for transitioning to a circular economy and is developing e-learning on circular procurement for staff.

Japan uses Building Information Modeling to optimise resource consumption and reduce waste during construction, with a focus on using recycled materials to promote sustainability in building projects.

Adopt Electric Vehicles

The share of EVs increased from 4% in 2020 to 18% in 2023 and is expected to grow in 2024. This trend reflects a global shift toward cleaner transportation, driven by technological advancements and rising environmental awareness.

The Delhi EV Policy aims to expand charging infrastructure and incentives, targeting 18,000 charging points by 2024, with 25% EV registrations and one charging outlet per 15 EVs citywide.

Singapore is adopting EVs to reduce land transport emissions as part of its net-zero goal, aiming to cut emissions by 1.5 to 2 million tonnes. The EV Roadmap targets cost parity with internal combustion engine (ICE) vehicles and 60,000 charging points by 2030.

Australia has set new rules to limit vehicle pollution, encouraging car makers to sell more electric vehicles and reduce transportation pollution.

Promote Circular Economy Marketplaces

Circular marketplaces play an important role in the new economy, changing the way we use, manufacture, and purpose materials and products.

The UK’s Material Reuse Portal aggregates surplus construction materials post-deconstruction, offering guidance and connections to service providers. It integrates with various data sources, can be customised for different locations, and provides free access to sustainable materials. Future plans include expanding marketplace partnerships to enhance material reuse.

Build Reuse is a US-based online marketplace specialising in salvaged and surplus building materials. It connects buyers and sellers for reclaimed items like wood, bricks, fixtures, and architectural elements, promoting resource efficiency and reducing construction waste.

Quantum computing is emerging as a groundbreaking force with the potential to reshape industries and enhance national security with unparalleled speed and precision. Governments and technology providers worldwide are heavily investing in this transformative technology, which promises significant advancements in areas such as cryptography, drug development, AI, and finance. Countries like Australia, Singapore, Taiwan, Qatar, and the UK are investing heavily in quantum research, backed by tech giants like Nvidia, IBM, and Google.

Ecosystm research finds that nearly 30% of enterprises are expecting to use quantum computing in the next 5 years.

Beyond Bits: Exploring the Potential of Quantum Computers

We need quantum computers because they have the potential to solve certain problems that are impossible (or impractical) for classical computers. Last year, Google led a study revealing that its quantum processor can complete a task in 6.18 seconds that would take a traditional supercomputer 47 years.

Here are a few reasons why quantum computing is exciting:

Unleashing the power of qubits. While classical computers use bits that can be either 0 or 1, quantum computers use qubits, which can exist in both states simultaneously (a state called superposition). This allows them to explore multiple possibilities simultaneously, making them significantly faster for specific tasks.

Tackling complex problems. Problems like simulating molecules or breaking complex encryption codes involve massive calculations. Quantum computers, with their unique properties, can manage these complexities more efficiently.

Revolutionising specific fields. Quantum computing has the potential to transform areas such as materials science, drug discovery, AI, and financial modelling. By simulating complex systems and processes, they could lead to breakthroughs in various sectors.

Quantum computers will not replace traditional computers entirely, but rather function as powerful tools for specific tasks beyond the reach of classical machines. Let’s look at cybersecurity as an example.

Twenty years ago, hacking was a basic task. Imagine a time before social media, when a simple computer and basic technical know-how were enough to breach a network. The stakes were low, the landscape uncomplicated. But technology, like threats, has evolved. Today’s hackers use sophisticated techniques, employing strategies like “harvest now, decrypt later” – stealing data today to decrypt later using more powerful machines. This is where quantum computing enters the scene, posing a significant threat to current encryption methods. In response, tech giants like Google, Apple, and Zoom are implementing quantum-resistant encryption into their software, safeguarding user data from potential future decryption attempts. Governments and telecommunication providers worldwide are boosting quantum encryption to tackle the potential security crisis.

The thrill of quantum computing lies in its infancy. Unforeseen applications, beyond our current imagination, could be unlocked as the technology matures.

Current Quantum Projects Focused on Security

First Scalable Network Secures Maritime Trade. The Netherlands is improving the resiliency of transport infrastructure in their own major international maritime hub, using quantum. The Port of Rotterdam Authority joined a collection of quantum technology firms to create a comprehensive cybersecurity ecosystem – the first of its kind globally. The port uses quantum technology to safeguard sensitive information, improving safety for the seagoing vessels carrying 470 million tonnes of cargo annually.

UK Integrates Quantum Navigation for Secure Air Travel. The UK is improving its digital transport infrastructure by integrating the first ever un-jammable aviation navigation system, powered by quantum software. This initiative was prompted by an incident where a government plane carrying the UK defence secretary had its GPS signal jammed close to Russian territory. This technology ensures safe and reliable navigation for aircraft, particularly in hostile environments. The UK government is investing USD 56 million into their quantum sector, aiming to become a quantum-enabled economy by 2033.

Governments Putting Faith in Quantum

Taiwan’s First Domestic 5-Qubit Computer. Taiwan is aiming to be a leader in quantum computing by building its first domestic machine by 2027. This initiative is part of a larger USD 259 million, five-year plan for quantum technology, and has a multi-pronged approach including building the actual quantum computer hardware; developing solutions to secure data in a world with quantum computers (quantum cryptography); creating a strong supply chain for quantum computing components within Taiwan; and collaborating with international partners to develop testing platforms and expertise.

Singapore Explores Real-World Applications. The Singaporean government has pledged USD 518 million to their National Quantum Strategy (NQS). This investment will provide the necessary resources to explore real-time applications of quantum technology in healthcare and technology. Simultaneously, they launched the National Quantum Processor Initiative (NQPI) to develop quantum sensors that will aid in research. Singapore aims to lead the world in quantum tech for investment portfolios, cryptography, and drug discovery.

Australia Aiming for World’s First Utility-Scale Machine. Backed by a USD 620 million investment from the Australian and Queensland governments, PsiQuantum aims to build a fault-tolerant computer that can solve previously challenging problems in fields like renewable energy, healthcare, and transportation. PsiQuantum’s innovative “fusion-based architecture” tackles scaling challenges by using millions of light-based qubits, paving the way for a new era of computational power and potentially sparking the next industrial revolution. This project positions Australia as a global leader in harnessing the immense potential of quantum computing.

Tech Companies Making the Quantum Leap

IBM Enhances Quantum Performance. IBM’s latest quantum computing platform, Qiskit 1.0, has worked on features that enhance performance, stability, and reliability. The updated open-source SDK aims to facilitate accessible quantum programming and accelerate processing times. Qiskit 1.0 uses optimised circuits to create and manage the interplay between classical and quantum computing. IBM is even collaborating with Japan’s AIST to develop a 10,000-qubit quantum computer by 2029, which is 75 times more powerful than current systems.

Microsoft and Quantinuum Achieve Reliable Logical Qubits. This significant milestone is said to mark a new era of dependable quantum technology, dramatically reducing errors and enhancing the precision of quantum computations. They have demonstrated an 800x improvement in error rates, paving the way for hybrid supercomputing systems that combine AI, high-performance computing (HPCs), and quantum capabilities to tackle scientific problems, with new capabilities becoming available to Azure Quantum Elements customers in the coming months.

Quantum Cloud Services for Enterprise. Major tech players QMware, Nvidia, and Oracle are teaming up to create hybrid quantum computing service for businesses. Combining classical and quantum computing, the project aims to crunch complex problems in AI, machine learning, and optimisation – all in the cloud.

Building Towards a Quantum Future

In the short term, using HPCs with quantum algorithms can already provide noticeable speed improvements over traditional methods. Hybrid approaches, where HPCs and quantum computers work together, could lead to significant gains in speed and efficiency, potentially ranging from 10x to 100x improvement.

Three strategies: quantum-inspired, hybrid, and full-scale quantum computing each offer distinct advantages.

While quantum-inspired computing leverages quantum algorithms to run on classical systems, hybrid computing combines classical and quantum processors, optimising the strengths of both to take complex problems more efficiently. Intuitively, full-scale quantum computing represents the ultimate goal, where large, fault-tolerant quantum computers solve problems beyond the reach of current classical systems.

Looking further ahead, the development of large-scale quantum computers could revolutionise industries by solving problems far beyond the reach of classical computers, with potential speedups of 500x to 1000x.

As quantum technology progresses, different industries and applications will benefit from tailored approaches that best suit their unique needs.