The Ecosystm RNx – Top 10 Global IT Services & Consulting Company Rankings is based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an End User, it is likely that you are looking to partner with the right services provider who can guide your transformation journey. This vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience, integration capabilities and strategy.

If you are an IT Services & Consulting Company, you operate in a competitive world with several global and regional players – this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

In this edition of Ecosystm RNx – an objective vendor ranking based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform – we rank the Top 10 Global Cybersecurity Vendors.

If you are an End User, you are having to re-evaluate your Cybersecurity risks and measures as both solution capabilities and the threat landscape become more complex. In a fragmented market, it is difficult to select the right Cybersecurity partner to safeguard your organisation. This vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are Cybersecurity Vendor, you are aware that end users are looking more for Cybersecurity services than solutions – this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

In this Insight, our guest author Anupam Verma talks about how the Global Capability Centres (GCCs) in India are poised to become Global Transformation Centres. “In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be ‘Digital Transformation Centres’ for global businesses.”

India has a lot to offer to the world of technology and transformation. Attracted by the talent pool, enabling policies, digital infrastructure, and competitive cost structure, MNCs have long embraced India as a preferred destination for Global Capability Centres (GCCs). It has been reported that India has more than 1,700 GCCs with an estimated global market share of over 50%.

GCCs employ around 1 million Indian professionals and has an immense impact on the economy, contributing an estimated USD 30 billion. US MNCs have the largest presence in the market and the dominating industries are BSFI, Engineering & Manufacturing, Tech & Consulting.

GCC capabilities have always been evolving

The journey began with MNCs setting up captives for cost optimisation & operational excellence. GCCs started handling operations (such as back-office and business support functions), IT support (such as app development and maintenance, remote IT infrastructure, and help desk) and customer service contact centres for the parent organisation.

In the second phase, MNCs started leveraging GCCs as centers of excellence (CoE). The focus then was product innovation, Engineering Design & R&D. BFSI and Professional Services firms started expanding the scope to cover research, underwriting, and consulting etc. Some global MNCs that have large GCCs in India are Apple, Microsoft, Google, Nissan, Ford, Qualcomm, Cisco, Wells Fargo, Bank of America, Barclays, Standard Chartered, and KPMG.

In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be “Digital Transformation Centres” for global businesses.

The New Age GCC in the post-COVID world

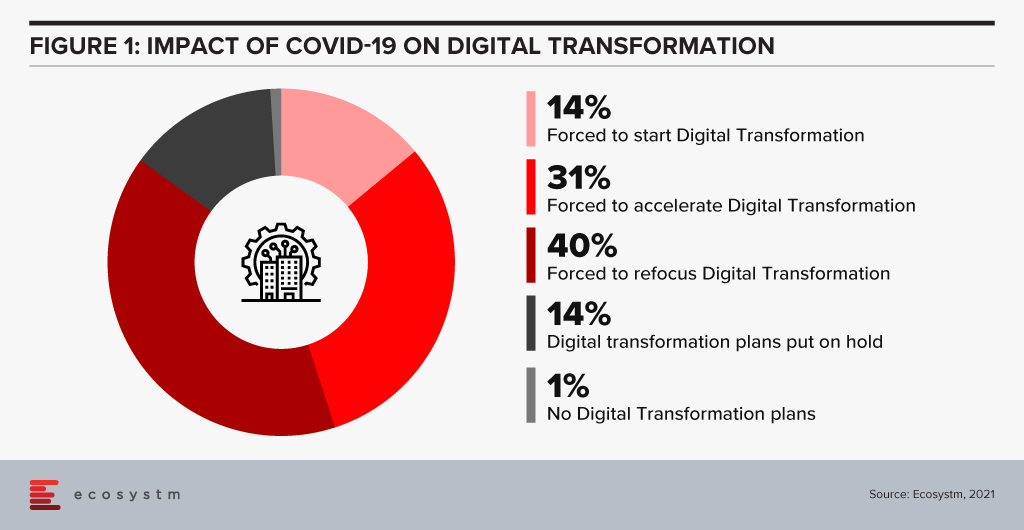

On one hand, the pandemic broke through cultural barriers that had prevented remote operations and work. The world became remote everything! On the other hand, it accelerated digital adoption in organisations. Businesses are re-imagining customer experiences and fast-tracking digital transformation enabled by technology (Figure 1). High digital adoption and rising customer expectations will also be a big catalyst for change.

In last few years, India has seen a surge in talent pool in emerging technologies such as data analytics, experience design, AI/ML, robotic process automation, IoT, cloud, blockchain and cybersecurity. GCCs in India will leverage this talent pool and play a pivotal role in enabling digital transformation at a global scale. GCCs will have direct and significant impacts on global business performance and top line growth creating long-term stakeholder value – and not be only about cost optimisation.

GCCs in India will also play an important role in digitisation and automation of existing processes, risk management and fraud prevention using data analytics and managing new risks like cybersecurity.

More and more MNCs in traditional businesses will add GCCs in India over the next decade and the existing 1,700 plus GCCs will grow in scale and scope focussing on innovation. Shift of supply chains to India will also be supported by Engineering R & D Centres. GCCs passed the pandemic test with flying colours when an exceptionally large workforce transitioned to the Work from Home model. In a matter of weeks, the resilience, continuity, and efficiency of GCCs returned to pre-pandemic levels with a distributed and remote workforce.

A Final Take

Having said that, I believe the growth spurt in GCCs in India will come from new-age businesses. Consumer-facing platforms (eCommerce marketplaces, Healthtechs, Edtechs, and Fintechs) are creating digital native businesses. As of June 2021, there are more than 700 unicorns trying to solve different problems using technology and data. Currently, very few unicorns have GCCs in India (notable names being Uber, Grab, Gojek). However, this segment will be one of the biggest growth drivers.

Currently, only 10% of the GCCs in India are from Asia Pacific organisations. Some of the prominent names being Hitachi, Rakuten, Panasonic, Samsung, LG, and Foxconn. Asian MNCs have an opportunity to move fast and stay relevant. This segment is also expected to grow disproportionately.

New age GCCs in India have the potential to be the crown jewel for global MNCs. For India, this has a huge potential for job creation and development of Smart City ecosystems. In this decade, growth of GCCs will be one of the core pillars of India’s journey to a USD 5 trillion economy.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Senior Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

Ecosystm RNx is an objective vendor ranking based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform. In this edition, we rank the Top 10 Global AI & Automation Vendors.

If you are an End-User, you are realising that the right investments in Data & AI now will be the key to your future success. This vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are an AI & Automation Vendor, it’s an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

In this first edition of Ecosystm RNx we rank the Top 10 Global Cloud Vendors.

Ecosystm RNx is an objective vendor ranking based on in-depth and quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an technology user, this Cloud Vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are a Cloud Vendor, this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

The Financial Services industry (FSI) in Indonesia is increasingly investing in digital. This is driven by both user demand and governmental incentives. However, organisations can be at very different stages of their digital maturity. Some organisations are in the early transitional stages while others are investing to enhance capabilities, they started investments in long ago. An understanding of the digital maturity of a typical financial services organisation in Indonesia gives their industry peers an opportunity to benchmark their technology and digital roadmap.

FSI in Indonesia is intensely competitive with a large number of players. There is competition from the fintech start-up community that is increasing market size and has driven a growing reliance on digital. Why is creating an exceptional customer experience a key differentiator in this competitive market? What are the impacts of OJK regulations on customer data management? How can a financial organisation create a single customer view across multiple channels and deliver personalised marketing initiatives?

Read this whitepaper to find out how digital-savvy customers are driving transformation in the financial services industry in Indonesia including:

- The key business priorities for 2021

- The shift in engagement strategies and channels

- The dependence on technology to support their marketing strategy

Click below to download the whitepaper

(Clicking on this link will take you to the Sitecore website where you can download the whitepaper)

Industries continue to innovate and disrupt to create and maintain a competitive edge – and their technology partners evolve their solution offerings to empower them.

We bring to you latest industry news from the Healthcare, Financial Services, Retail, Travel & Hospitality and Entertainment & Media industries to show you how organisations are leveraging technology. Find out more about organisations such as Services Australia, Paypal, Walmart, Zara and Amex – and how tech providers such as IBM, Oracle, Google and Uplift are supporting organisations across industries.

View the latest Ecosystm Bytes on Industries of the Future below, and reach out to our experts if you have questions.

For more ‘byte sized’ insights click on the link below

Organisations are increasingly investing in digital. However, they are at different stages of their digital maturity. Some companies are in the early transitional stages while others are investing to upgrade capabilities they instituted long ago. An understanding of the digital maturity of a typical organisation in your market/industry can help you benchmark your technology and. digital roadmap.

This ebook presents some key findings for financial services within Indonesia. You will get insights on impact of COVID-19 on transformation journeys, key business priorities for 2021, and the shift in engagement strategies and channels.

Click below to download the eBook

(Clicking on this link will take you to Sitecore website where you can download the eBook)

This whitepaper is designed to inform travel and transport sector professionals on the growth of and opportunity for video analytics in their business – to spark new ideas and start conversations on how video analytics can help them continue to improve their service for all stakeholders.

For transportation companies of all types and sizes the use of intelligent video analysis make video actionable, searchable, insightful and quantifiable to draw actionable intelligence, closely monitor real-time spaces and overcome dynamic challenges.

What’s Inside?

- Industry Overview – Overall impact and journey to pre-pandemic levels

- Public and private sector transportation investments in advanced analytics

- The market for video analytics – Project lifecycle, Global Data, Insights, Trends, Adoption models

- Use Cases for Video Analytics in Smart Transportation

Download Whitepaper – Video Analytics in the Transport Sector

Clicking on the above link will take you to HPE Website