In the Ecosystm Predicts: The Top 5 AI & Automation Trends for 2021, we had seen 2021 as the year when organisations re-evaluated their AI and automation roadmaps more actively. With the increase in interest in AI, there has been a buzz around Ethics and the use of AI. The drive to focus on Ethics has become an all-pervasive discussion.

We are seeing global bodies shape the conversation; several country-level initiatives to re-frame AI Ethics frameworks; tech vendors and organisations build Ethics into their marketing messages; and AI education courses attempting to introduce the concept early within the developer community.

This Ecosystm Snapshot provides a brief overview of the recent key initiatives that are shaping the conversation on Ethics & AI.

Ransomware attacks have become a real threat to organisations world-wide – SonicWall reports that there were 304.7 million attacks globally in the first half of 2021, surpassing the full-year total for 2020. Organisations today are challenged with having the right cybersecurity measure in place, with cyber-attacks considered an inevitability.

This also challenges tech providers and cybersecurity vendors, as they have to constantly evolve their security offerings to protect their client organisations.

Ecosystm analysts, Alan Hesketh, Andrew Milroy and Claus Mortensen discuss the challenges tech providers face and how they are evolving their capabilities – organically, through acquisitions (Microsoft) and through partnerships (Google).

In this Insight, guest author Anupam Verma talks about the technology-led evolution of the Banking industry in India and offers Cloud Service Providers guidance on how to partner with banks and financial institutions. “It is well understood that the banks that were early adopters of cloud have clearly gained market share during COVID-19. Banks are keen to adopt cloud but need a partnership approach balancing innovation with risk management so that it is ‘not one step forward and two steps back’ for them.”

India has been witnessing a digital revolution. Rapidly rising mobile and internet penetration has created an estimated 1 billion mobile users and more than 600 million internet users. It has been reported that 99% of India’s adult population now has a digital identity in the form of Aadhar and a large proportion of the adult Indians have a bank account.

Indians are adapting to consume multiple services on the smartphone and are demanding the same from their financial services providers. COVID-19 has accelerated this digital trend beyond imagination and is transforming India from a data-poor to a data-rich nation. This data from various alternate sources coupled with traditional sources is the inflection point to the road to financial inclusion. Strong digital infrastructure and digital footprints will create a world of opportunities for incumbent banks, non-banks as well as new-age fintechs.

The Cloud Imperative for Banks

Banks today have an urgent need to stay relevant in the era of digitally savvy customers and rising fintechs. This journey for banks to survive and thrive will put Data Analytics and Cloud at the front and centre of their digital transformation.

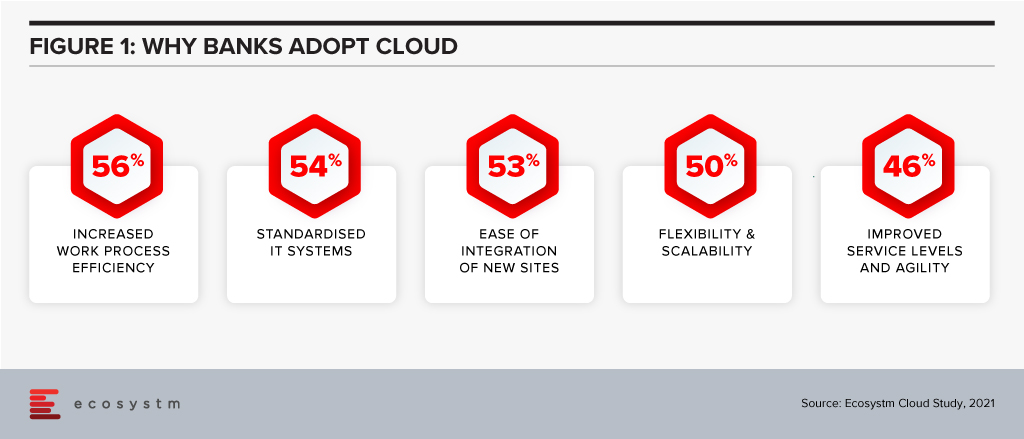

A couple of years ago, banks viewed cloud as an outsourcing infrastructure to improve the cost curve. Today, banks are convinced that cloud provides many more advantages (Figure 1).

Banks are also increasingly partnering with fintechs for applications such as KYC, UI/UX and customer service. Fintechs are cloud-native and understand that cloud provides exponential innovation, speed to market, scalability, resilience, a better cost curve and security. They understand their business will not exist or reach scale if not for cloud. These bank-fintech partnerships are also making banks understand the cloud imperative.

Traditionally, banks in India have had concerns around data privacy and data sovereignty. There are also risks around migrating legacy systems, which are made of monolithic applications and do not have a service-oriented architecture. As a result, banks are now working on complete re-architecture of the core legacy systems. Banks are creating web services on top of legacy systems, which can talk to the new technologies. New applications being built are cloud ready. In fact, many applications may not connect to the core legacy systems. They are exploring moving customer interfaces, CRM applications and internal workflows to the cloud. Still early days, but banks are using cloud analytics for marketing campaigns, risk modelling and regulatory reporting.

The remote working world is irreversible, and banks also understand that cloud will form the backbone for internal communication, virtual desktops, and virtual collaboration.

Strategy for Cloud Service Providers (CSPs)

It is estimated that India’s public cloud services market is likely to become the largest market in the Asia Pacific behind only China, Australia, and Japan. Ecosystm research shows that 70% of banking organisations in India are looking to increase their cloud spending. Whichever way one looks at it, cloud is likely to remain a large and growing market. The Financial Services industry will be one of the prominent segments and should remain a focus for cloud service providers (CSPs).

I believe CSPs targeting India’s Banking industry should bucket their strategy under four key themes:

- Partnering to Innovate and co-create solutions. CSPs must work with each business within the bank and re-imagine customer journeys and process workflow. This would mean banking domain experts and engineering teams of CSPs working with relevant teams within the bank. For some customer journeys, the teams have to go back to first principles and start from scratch i.e the financial need of the customer and how it is being re-imagined and fulfilled in a digital world.

CSPs should also continue to engage with all ecosystem partners of banks to co-create cloud-native solutions. These partners could range from fintechs to vendors for HR, Finance, business reporting, regulatory reporting, data providers (which feeds into analytics engine).

CSPs should partner with banks for experimentation by providing test environments. Some of the themes that are critical for banks right now are CRM, workspace virtualisation and collaboration tools. CSPs could leverage these themes to open the doors. API banking is another area for co-creating solutions. Core systems cannot be ‘lifted & shifted’ to the cloud. That would be the last mile in the digital transformation journey. - Partnering to mitigate ‘fear of the unknown’. As in the case of any key strategic shift, the tone of the executive management is important. A lot of engagement is required with the entire senior management team to build the ‘trust quotient’ of cloud. Understanding the benefits, risks, controls and the concept of ‘shared responsibility’ is important. I am an AWS Certified Cloud Practitioner and I realise how granular the security in the cloud can be (which is the responsibility of the bank and not of the CSP). This knowledge gap can be massive for smaller banks due to the non-availability of talent. If security in the cloud is not managed well, there is an immense risk to the banks.

- Partnering for Risk Mitigation. Regulators will expect banks to treat CSPs like any other outsourcing service providers. CSPs should work with banks to create robust cloud governance frameworks for mitigating cloud-related risks such as resiliency, cybersecurity etc. Adequate communication is required to showcase the controls around data privacy (data at rest and transit), data sovereignty, geographic diversity of Availability Zones (to mitigate risks around natural calamities like floods) and Disaster Recovery (DR) site.

- Partnering with Regulators. Building regulatory comfort is an equally important factor for the pace and extent of technology adoption in Financial Services. The regulators expect the banks to have a governance framework, detailed policies and operating guidelines covering assessment, contractual consideration, audit, inspection, change management, cybersecurity, exit plan etc. While partnering with regulators on creating the framework is important, it is equally important to demonstrate that banks have the skill sets to run the cloud and manage the risks. Engagement should also be linked to specific use cases which allow banks to effectively compete with fintech’s in the digital world (and expand financial access) and use cases for risk mitigation and fraud management. This would meet the regulator’s dual objective of market development as well as market stability.

Financial Services is a large and growing market for CSPs. Fintechs are cloud-native and certain sectors in the industry (like non-banks and insurance companies) have made progress in cloud adoption. It is well understood that the banks that were early adopters of cloud have clearly gained market share during COVID-19. Banks are keen to adopt cloud but need a partnership approach balancing innovation with risk management so that it is ‘not one step forward and two steps back’ for them.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

An Update (1 October 2021): This acquisition did not go through even after the boards of directors of both companies had approved it. It was voted down by Five9 shareholders, citing growth and valuation concerns. This is an unusual example of an acquisition not going through because of unwillingness of one of the companies. In recent times, regulators have stopped some acquisitions. Incidentally, there were some concerns raised by the by Federal Communications Commission (FCC) as Zoom is based in US. but has product development operations in China.

The partnership arrangement between the two companies will continue including support for integrations between their respective Unified Communications as a Service (UCaaS) and Contact Centre as a Service (CCaaS) solutions and joint go-to-market initiatives.

Zoom has announced their intention to acquire cloud contact centre service provider Five9 in an all-stock deal for about USD 14.7 Billion. This is Zoom’s largest-ever acquisition as the communications platform continues to expand their services and launch new products. The deal is expected to be completed in the first half of 2022 and Five9 will be an operating unit of Zoom.

The last year has seen Zoom scaling up their product offerings, including cloud calling solution – Zoom Phone, conference hosting solution – Zoom Rooms, and applications and productivity tools – Zoom Apps and Zoom Marketplace. Zoom also acquired real-time translation startup Kites GmbH to offer multi-language translation capabilities, and Keybase – a secure messaging and file-sharing service to build end-to-end encryption for its video conferencing platform.

Ecosystm Analysts share their thoughts on Zoom’s strategy and roadmap, how Five9 will augment Zoom’s capabilities, and the impact the acquisition will have on Zoom’s competitors and the market.

Why Contact Centre?

Ecosystm Principal Advisor Tim Sheedy says, “Zoom is moving beyond its period of ‘organic hypergrowth’ brought on by the pandemic. While the paying customer base for their core video collaboration service will continue to grow, growth rates are likely to begin to track the market. To grow beyond market rates, Zoom needs to move into new markets – through product development or acquisition.”

Talking about the importance of voice services, Sheedy adds, “Voice services are an obvious adjacent market to help drive growth, and Zoom already has seen some success with their Zoom phone service and associated devices – in fact, they already have 1.5 million users. The Five9 acquisition gives the company a stronger and deeper capability in the voice sector; buying them a significant chunk of the voice services in business – the contact centre. In many businesses, the contact centre already accounts for over 50% of their voice minute usage, so winning this space will go a long way towards winning the overall voice and collaboration supplier in enterprises.”

Ecosystm Principal Advisor Audrey William predicts exciting times ahead for Zoom. “With Zoom already having a platform for video, then bringing voice into that equation and now a contact centre solution, makes them take on their competitors in an all-native cloud stack. There is a still a large installed base of on-prem UC customers and with Zoom seeing success with Zoom phones in the short time frame since its launch, this is where this will get exciting for Zoom. The telephony piece is still important in the race to simplify how we work, communicate, and collaborate today. It is that same voice/telephony discussion that can lead to a routing discussion, which then leads to a contact centre discussion.”

Ecosystm research shows that 54% of organisations are challenged in their customer experience delivery because of integration issues between multiple platforms. William sees this as an opportunity for Zoom. “The use cases to integrate workflows into the video environment is going to be important for Zoom. Video is now being used to solve customer service issues like letting the agents take over the screen to see how to help solve the customer problem immediately by using video and contact centre applications. The ability to bring this natively together will be very powerful. Zoom is investing heavily into apps and working to partner with ISVs who can develop workflows suitable for easy customer communication in specific industries such as Healthcare and Financial Services.”

Why Five9?

Five9 is considered a pioneer in cloud contact centre solutions and owns a comprehensive suite of applications for contact centre delivery and customer management operations across different channels. Five9 has made several acquisitions and enhancements to their CCaaS solution in recent years to make their stack more complete with richer AI offerings. They include Inference Solutions to offer their customers a Conversational AI solution and Whendu’s iPaaS platform which provides a no-code, visual application workflow tool.

William says, “More contact centres want to do away with monolithic IVR systems that confuse customers with too many long menus. The Agent Assist solutions are also gaining importance especially in the hybrid work model where agents face challenges working in isolation and not being on a floor with their colleagues and managers.”

Five9 has acquired a cloud workforce optimisation provider Virtual Observer. “So, we are not looking at just a basic level contact centre solution but an offering with important capabilities demanded by customers,” says William. “During the investor call this week, Zoom’s Eric Yuan and Rowan Trollope made it clear that they have been listening to customer feedback on how effective it would be to have a single platform that can accommodate UC and contact centres in the cloud. Zoom also sees Five9 as a good fit culturally; and their goal now will be to disrupt all legacy systems with cloud-native communications.”

What lies ahead?

William thinks that Zoom’s competitors will be watching this integration closely, especially those that lack an all-in-one native cloud UCaaS and CCaaS stack. “However, some of Zoom’s competitors have an established base of large enterprise customers and have done well to grow revenues and defend their base over the years. Working with in-country partners and ISVs will be critical for Zoom’s growth across regions.”

Sheedy thinks that the most important takeaway from this acquisition is not that Zoom is moving into the contact centre space. “It is that Zoom realises they have a “once in a generation” opportunity to grow beyond their core and cement their position as a supplier of collaboration and communication services – and that they are willing to flex their balance sheet and share price to create their future. The competition – from Microsoft in particular – will be strong. Google, AWS, Salesforce, and Facebook are also making a play for this market. Zoom has found themselves in their current position of strength due to good luck and good timing – and they appear to be telling the market that they aren’t going to give up their leadership without a significant battle.”

“Enterprises will be the true winners in this battle – with better, more integrated, lower cost and easier to implement communications and collaboration solutions for their employees and customers,” adds Sheedy.

Ecosystm launches the Trending-Vendor series showcasing the Top 5 disruptive vendors that are shaking up their market segment. Our first Trending-Vendor RNx is focused on Robotic Process Automation (RPA) – Ecosystm research shows that process automation is the biggest driver for tech adoption, with a staggering 127% investment growth in 2021. The Ecosystm RNx – Top 5 Trending-Vendor for RPA evaluates Automation vendors based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an End User and looking to automate your back-end or customer processes, this vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience, integration capabilities, and strategy.

If you are an RPA vendor, you operate in a competitive work with several enterprise vendors vying for a larger share of the pie – this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

The Media & Entertainment industry has enjoyed a boom over the last year – and the Sports industry has a key role to play in that. As sporting events resume this year, the conversations are increasingly about what technology can achieve. How can technology keep players and fans safe? How to leverage technology to give the virtual audience a real-life experience of their favourite sporting event? Which are the technologies that should be leveraged to maintain audience engagement?

Here are some examples of how immersive technologies are delighting fans globally; how technology providers are focusing on creating solutions to capture a larger share of this growing market; and the growth of innovative, tech-driven ecosystems in the industry.

Two years ago at Discover, HP Enterprise’s President and CEO, Antonio Neri promised that all of HPE’s portfolio would be available ‘as a service’ within three years.

At the current Discover virtual events, HPE made a series of announcements to showcase that GreenLake is on its way to meet that ambitious goal in 2022. HPE continues to evolve their enterprise capabilities, as is demonstrated by their acquisitions of Determined AI and Zerto.

Ecosystm Advisors, Alan Hesketh, Darian Bird, and Niloy Mukherjee comment on how HPE is preparing for the Hybrid world and the key announcements at HPE Discover, 2021 including GreenLake, Lighthouse, and Aurora.

BHP – the multinational mining giant – has signed agreements with AWS and Microsoft Azure as their long-term cloud providers to support their digital transformation journey. This move is expected to accelerate BHP’s cloud journey, helping them deploy and scale their digital operations to the workforce quickly while reducing the need for on-premises infrastructure.

Ecosystm research has consistently shown that many large organisations are using the learnings from how the COVID-19 pandemic impacted their business to re-evaluate their Digital Transformation strategy – leveraging next generation cloud, machine learning and data analytics capabilities.

BHP’s Dual Cloud Strategy

BHP is set to use AWS’s analytics, machine learning, storage and compute platform to deploy digital services and improve operational performance. They will also launch an AWS Cloud Academy Program to train and upskill their employees on AWS cloud skills – joining other Australian companies supporting their digital workforce by forming cloud guilds such as National Australia Bank, Telstra and Kmart Group.

Meanwhile, BHP will use Microsoft’s Azure cloud platform to host their global applications portfolio including SAP S/4 HANA environment. This is expected to enable BHP to reduce their reliance on regional data centres and leverage Microsoft’s cloud environment, licenses and SAP applications. The deal extends their existing relationship with Microsoft where BHP is using Office 365, Dynamics 365 and HoloLens 2 platforms to support their productivity and remote operations.

Ecosystm principal Advisor, Alan Hesketh says, “This dual sourcing is likely to achieve cost benefits for BHP from a competitive negotiation stand-point, and positions BHP well to negotiate further improvements in the future. With their scale, BHP has negotiating power that most cloud service customers cannot achieve – although an effective competitive process is likely to offer tech buyers some improvements in pricing.”

Can this Strategy Work for You?

Hesketh thinks that the split between Microsoft for Operations and AWS for Analytics will provide some interesting challenges for BHP. “It is likely that high volumes of data will need to be moved between the two platforms, particularly from Operations to Analytics and AI. The trend is to run time-critical analytics directly from the operational systems using the power of in-memory databases and the scalable cloud platform.”

“As BHP states, using the cloud reduces the need to put hardware on-premises, and allows the faster deployment of digital innovations from these cloud platforms. While achieving technical and cost improvements in their Operations and Analytics domains, it may compromise the user experience (UX). The UX delivered by the two clouds is quite different – so delivering an integrated experience is likely to require an additional layer that is capable of delivering a consistent UX. BHP already has a strong network infrastructure in place, so they are likely to achieve this within their existing platforms. If there is a need to build this UX layer, it is likely to reduce the speed of deployment that BHP is targeting with the dual cloud procurement approach.”

Many businesses that have previously preferred a single cloud vendor will find that they will increasingly evaluate multiple cloud environments, in the future. The adoption of modern development environments and architectures such as containers, microservices, open-source, and DevOps will help them run their applications and processes on the most suitable cloud option.

While this strategy may well work for BHP, Hesketh adds, “Tech buyers considering a hybrid approach to cloud deployment need to have robust enterprise and technology architectures in place to make sure the users get the experience they need to support their roles.”

This Ecosystm authored whitepaper, “Logistics Transformation with Automated Yard Management”, sponsored by Alfabeta in partnership with Intel, discusses the challenges faced in yard management activities, and how these challenges can be addressed by automated yard management solutions and technologies like AI, IoT and cloud.

Whitepaper – Logistics Transformation with Automated Yard Management

(Clicking on this link will take you to the Intel’s website where you can download the whitepaper)