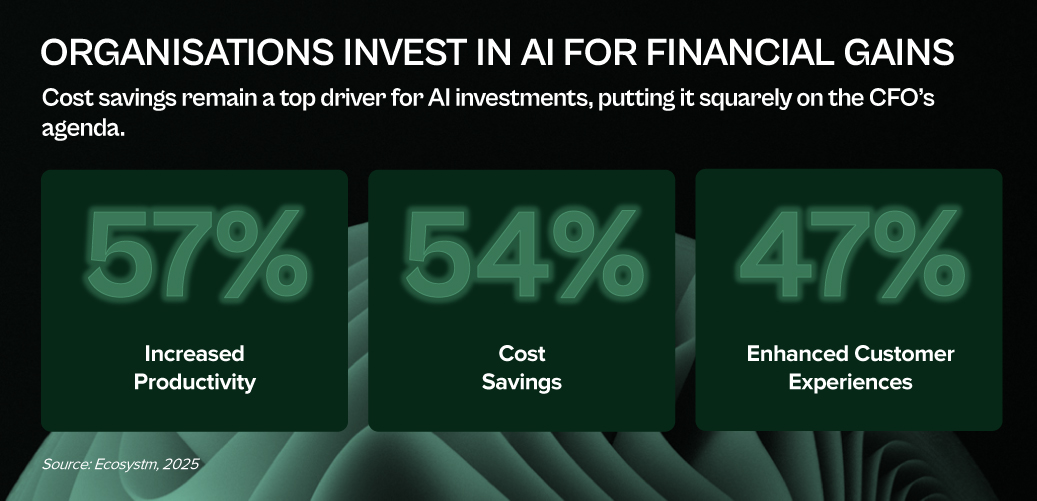

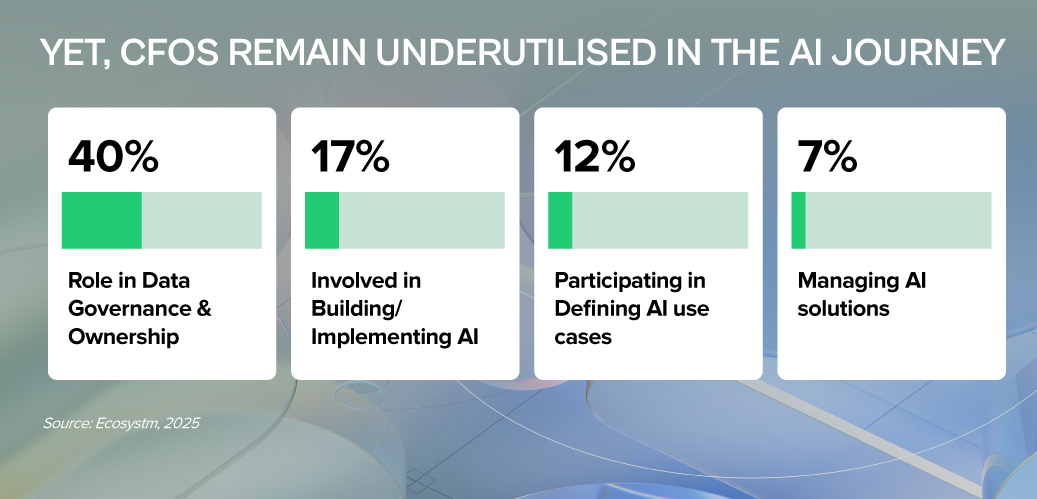

AI is not just reshaping how businesses operate — it’s redefining the CFO’s role at the centre of value creation, risk management, and operational leadership.

As stewards of capital, CFOs must cut through the hype and ensure AI investments deliver measurable business returns. As guardians of risk and compliance, they must shield their organisations from new threats — from algorithmic bias to data privacy breaches with heavy financial and reputational costs. And as leaders of their function, CFOs now have a generational opportunity to modernise finance, champion AI adoption, and build teams ready for an AI-powered future.

LEAD WITH RIGOUR. SAFEGUARD WITH VIGILANCE. CHAMPION WITH VISION.

That’s the CFO playbook for AI success.

Click here to download “AI Stakeholders: The Finance Perspective” as a PDF.

1. Investor & ROI Gatekeeper: Ensuring AI Delivers Value

CFOs must scrutinise AI investments with the same discipline as any major capital allocation.

- Demand Clear Business Cases. Every AI initiative should articulate the problem solved, expected gains (cost, efficiency, accuracy), and specific KPIs.

- Prioritise Tangible ROI. Focus on AI projects that show measurable impact. Start with high-return, lower-risk use cases before scaling.

- Assess Total Cost of Ownership (TCO). Go beyond upfront costs – factor in integration, maintenance, training, and ongoing AI model management.

Only 37% of Asia Pacific organisations invest in FinOps to cut costs, boost efficiency, and strengthen financial governance over tech spend.

2. Risk & Compliance Steward: Navigating AI’s New Risk Landscape

AI brings significant regulatory, compliance, and reputational risks that CFOs must manage – in partnership with peers across the business.

- Champion Data Quality & Governance. Enforce rigorous data standards and collaborate with IT, risk, and business teams to ensure accuracy, integrity, and compliance across the enterprise.

- Ensure Data Accessibility. Break down silos with CIOs and CDOs and invest in shared infrastructure that AI initiatives depend on – from data lakes to robust APIs.

- Address Bias & Safeguard Privacy. Monitor AI models to detect bias, especially in sensitive processes, while ensuring compliance.

- Protect Security & Prevent Breaches. Strengthen defences around financial and personal data to avoid costly security incidents and regulatory penalties.

3. AI Champion & Business Leader: Driving Adoption in Finance

Beyond gatekeeping, CFOs must actively champion AI to transform finance operations and build future-ready teams.

- Identify High-Impact Use Cases. Work with teams to apply AI where it solves real pain points – from automating accounts payable to improving forecasting and fraud detection.

- Build AI Literacy. Help finance teams see AI as an augmentation tool, not a threat. Invest in upskilling while identifying gaps – from data management to AI model oversight.

- Set AI Governance Frameworks. Define accountability, roles, and control mechanisms to ensure responsible AI use across finance.

- Stay Ahead of the Curve. Monitor emerging tech that can streamline finance and bring in expert partners to fast-track AI adoption and results.

CFOs: From Gatekeepers to Growth Drivers

AI is not just a tech shift – it’s a CFO mandate. To lead, CFOs must embrace three roles: Investor, ensuring every AI bet delivers real ROI; Risk Guardian, protecting data integrity and compliance in a world of new risks; and AI Champion, embedding AI into finance teams to boost speed, accuracy, and insight.

This is how finance moves from record-keeping to value creation. With focused leadership and smart collaboration, CFOs can turn AI from buzzword to business impact.