There has been a heightened interest in the cloud in EMEA in recent times, triggered by several regional and country level announcements.

The European Union (EU) founded the GAIA-X Foundation to build a unified system of cloud and data services to be protected by EU Laws – including GDPR, the free flow of non-personal data regulation and the Cybersecurity Act. France and Germany kicked off the GAIA-X cloud project last year and the system is open for participation to national and European initiatives for exchange of data across industries and services such as AI, IoT and data analytics. GAIA-X took another step towards becoming a real option for European organisations with the establishment as a legal entity in June. Founding members of GAIA-X include Atos, Bosch, BMW, Deutsche Telekom, EDF, German Edge Cloud, Orange, OVHcloud, SAP, and Siemens. Non-European providers, such as AWS, Microsoft, Google, and IBM will also have the opportunity to join GAIA-X. The UK Crown Commercial Service (CCS) has also been entering into agreements with public cloud platform providers to encourage increased cloud adoption in cash-strapped public sector organisations. It is a good time to evaluate organisations’ perception on cloud and their adoption patterns.

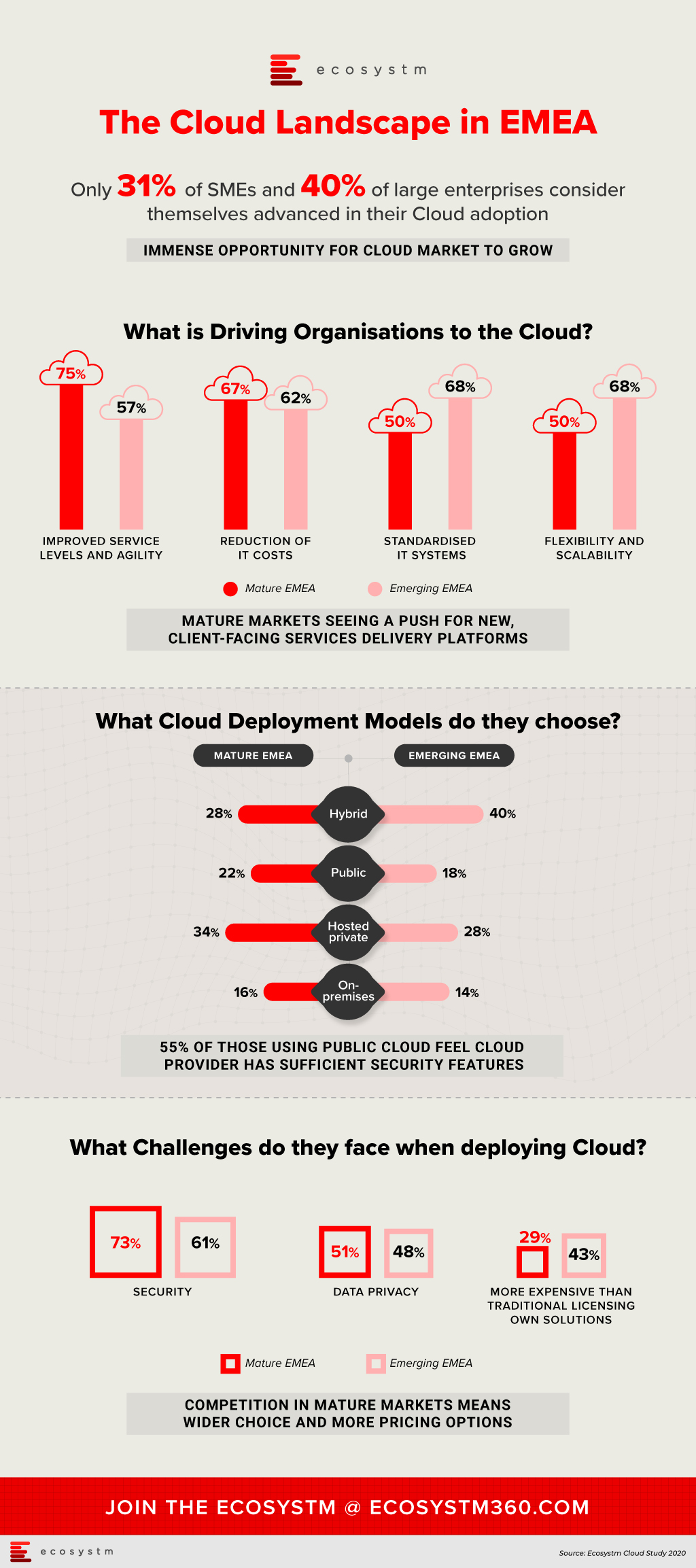

Ecosystm research finds that while most organisations have migrated at least some simple workloads to the cloud, the sophistication of these systems ranges from SaaS deployed as shadow IT, all the way up to cloud-native applications that are core to a digital business strategy. When asked about the maturity of their cloud deployments, 36% of organisations in EMEA consider themselves advanced, leaving the remaining 64% with more basic environments. These figures vary by business size with only 31% of SMEs considering their deployments advanced, rising to 40% for large enterprises.

Cloud technology providers should segment the market according to the maturity of their client’s systems. Those in the early stages of modernising their infrastructure will be seeking different benefits and will have different concerns than those already using cloud to underpin their digital transformation.

In the mature economies in the region, 75% of those with advanced deployments, considered improved service levels and agility as a key benefit of cloud. These organisations have moved beyond simply replacing legacy systems with cloud infrastructure and now look to the IT department to provide a platform on which new, client-facing services can be delivered. In the emerging economies, the most-reported benefits of cloud are flexibility and scalability, and standardised systems, both at 68% of respondents. These could be viewed as benefits expected from organisations not as far along in the cloud journey. The benefit of reduced IT costs was important in both mature EMEA (67%) and emerging EMEA (62%).

Looking at those who consider their cloud deployments as still basic, security is the leading challenge to greater adoption and by a large margin. Of those respondents in mature EMEA, 73% cited security as a key challenge, more than 20 percentage points higher than the next greatest difficulty. In emerging EMEA, a similar trend was evident, with 61% of respondents considering security as a key challenge. Moreover, data privacy is the second-most significant concern for those who do not consider their cloud deployments advanced. This was visible in both mature EMEA (51%) and emerging EMEA (48%). As organisations look to shift more critical workloads to the cloud, they will be increasing their attack surfaces and at the same time will face greater consequences if a breach does occur.

Services providers targeting organisations with less developed cloud environments should include security early in the conversation to push them along to the next stage of maturity.

The challenge that varied most according to market maturity and business size was the concern that cloud-based services were more expensive that traditional licencing or in-house solutions. Only 29% of respondents with basic cloud deployments in the mature economies, held this view, while in emerging economies the figure rose to 43%. Competition in those mature markets has in some cases put pressure on prices or at least resulted in wider choice. While 29% of SME respondents considered cost a key challenge, 41% of large enterprises did. Migrating larger, more complex environments to cloud will be viewed as more costly than the status quo due to organisational inertia.

The perception that cloud can be more costly, provides an opportunity for cloud management including expense optimisation services.

Organisations looking to move from a basic cloud environment to one that adopts a cloud-first model should begin with a maturity assessment. Understand what your systems will look like at the next stage, what the benefits will be, and what are the risks. More importantly, decide on the long-term business goal that you are trying to achieve, particularly how IT can be a critical player in the organisation’s digital strategy.

Note: Mature economies – France, Germany and the UK/ Emerging economies – Middle Eastern countries, Russia and South AfricaIdentify emerging cloud computing trends that can help you drive digital business decision making, vendor and technology platform selection and investment strategies.Gain access to more insights from the Ecosystm Cloud Study.